The Account Maintenance button

contains a listing of all account names. The most commonly used GL codes are

preset as below.

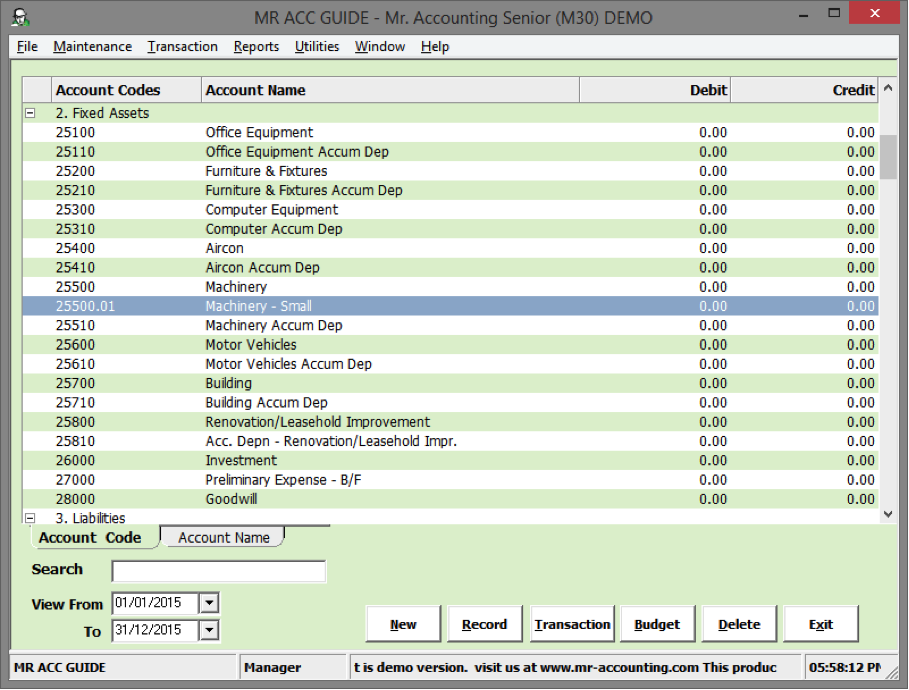

Account Maintenance Quick View screen.

1.

Transaction: This shows a history of

transactions involving this GL code [see above]

2.

Budget: [see below]

Select New to create a GL code

and double click on a GL code

to edit.

1.

Creating sub GL

codes

General Ledger

Code: This usually starts with

the Account Type number and 4 digits and the end (e.g. 1XXXX for Current Assets

GL code)

Account

Name: This appears in the

Account Maintenance Quick View screen

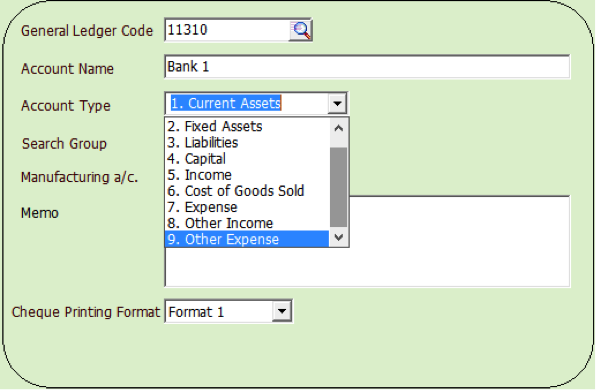

Account

Type:

Search

Group:

Manufacturing

A/C: Set this to manufacturing

account type for the balance to be included in the manufacturing profit or loss

report

Memo: Enter

additional details for this GL code

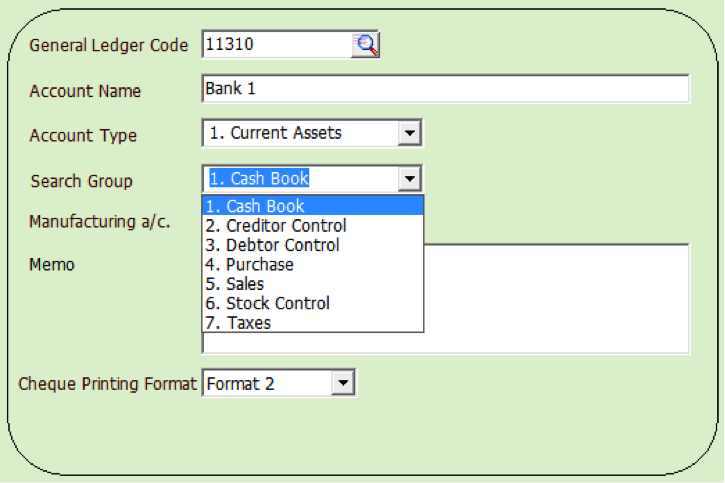

Printing Format: Set which cheque format

to print. You need to set the Search Group to “1. Cash

Book”

Account Type

The Account Types are elements in the

balance sheet and profit or loss (e.g. assets, income etc). The Account Type

determines whether the item falls under the balance sheet or profit of loss

report. There are 9 account types in Mr Accounting [see

below].

Each Account Type is given a number in front. The GL code you create should begin with this number (e.g. Bank 1 (11310) begins with the Current Assets number in front).

Search Group

You need to set the search group for

each GL code to allocate which transaction it belongs to. After you allocate a

GL code to a search group, it will show up when you select the magnifying glass

icon.

There are 7 search groups as

below.

If you don’t allocate a GL code, then

nothing shows up unless you select the Show All button [see example below].

Example:

After you have allocated the Bank 1

(11310) GL code to the search group “1. Cash Book”, then this GL code appears

[highlighted in blue] when you select the magnifying glass [in red box] to

select Bank code.

1.

If you didn’t allocate

the GL code to this search group, it doesn’t appear here. You need to browse all

GL codes to select the code by pressing the Show All

button.

Which module and transactions are associated with each search group?

|

Search Group |

Which Module/

Transaction |

|

1. Cash Book |

Customer

Receipt,

Supplier

Payment,

Cash

Book Payment/Receipt |

|

2. Creditor Control |

Default/Credit

Settings for suppliers in Supplier

Master

and Default Settings in

Supplier

module |

|

3. Debtor Control |

Default/Credit

Settings for customers in Customer

Master

and

Default Settings in Customer

module |

|

4. Purchase |

Default

Settings and transactions in Supplier,

Purchase

Order,

Default Settings in Stock

Control

module |

|

5. Sales |

Default

Settings and transactions in

Customer,

Sales

Order,

and Invoicing

module

except Delivery

Order,

Default Settings in Stock

Control

module |

|

6. Stock Control |

Closing

Stock

button

in General

Ledger

module |

|

7. Taxes |

Default

Settings in GST

module |

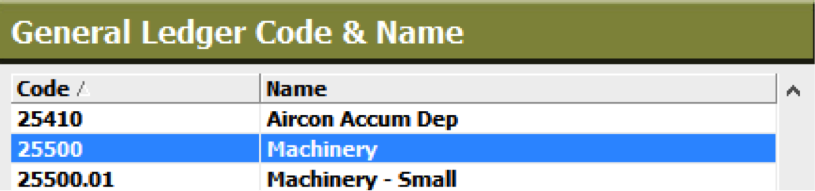

Creating Sub GL codes

Sub GL codes appear under the main GL code in the Account

Maintenance

screen.

Example:

Create a sub GL code under the main GL code Machinery

(25500).

Select General Ledger

→ Account Maintenance → New

1.

Add “.01” at the end of

the GL code. E.g. type 25500.01

2.

The sub GL code falls

under the category of the main GL code (e.g. Machinery – Small)

The newly created GL code

will appear under 25500 in Account

Maintenance Quick View

screen.

Note: The main GL code (25500) is still a

posting account which you can post transactions to, and will show up in search

[highlighted in blue below].

Select the Budget button from the Account

Maintenance Quick View or double

click for GL code details and select the Budget tab [in red box] to arrive at

this screen.

The screen shows the total balance for this GL code

for each month in the financial year under the Actuals column and allows you to set a

budgeted figure for each month under the Budget column [see

below].

This is only for monitoring purposes. The

system does not restrict transactions into and out from this GL code.

1.

Method 1: Type in budget figure for each

month

2.

Method 2: Type in total budget figure under the Grand Total row. The monthly budget is

the averaged out based on this figure (e.g.

6000/12=500)