This is to preview and print a list of transactions for each tax code by selected categories [see below for examples of each format].

1.

Show only Unreconcile

records: Tick this to include only transactions that

have not been reconciled

Note: If you don’t tick the Show only Unreconcile records function,

then this report shows all transactions including those that have been

reconciled and submitted for the previous GST Return

form.

You can use this function to check for

transactions that apply to this GST Return form. For example, you may have

received a backdated invoice for the previous period after submitting the GST

Return form. You can select the previous period and tick this checkbox to

include this transaction.

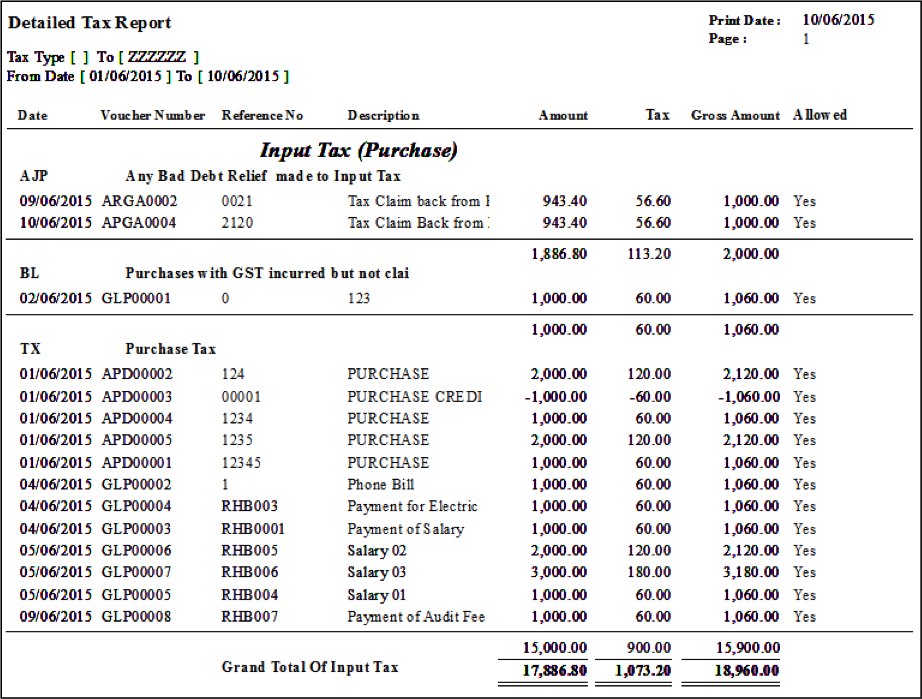

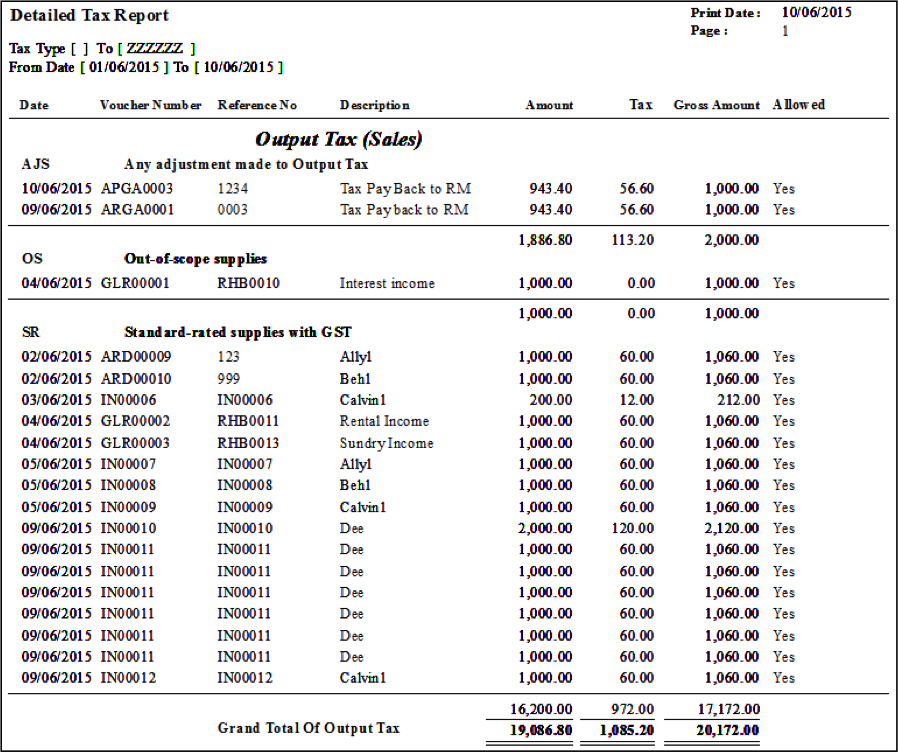

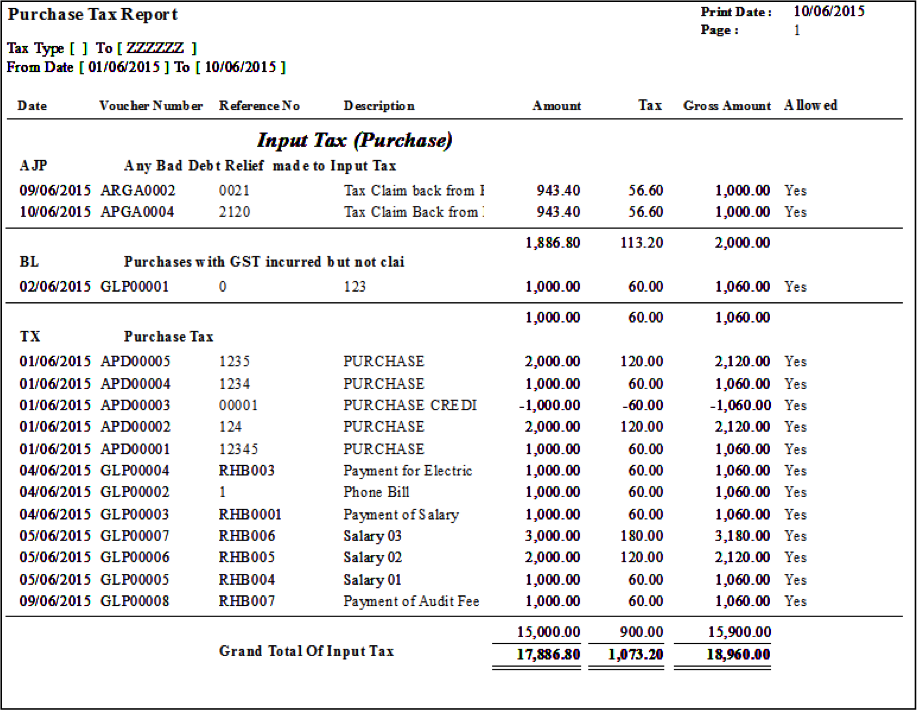

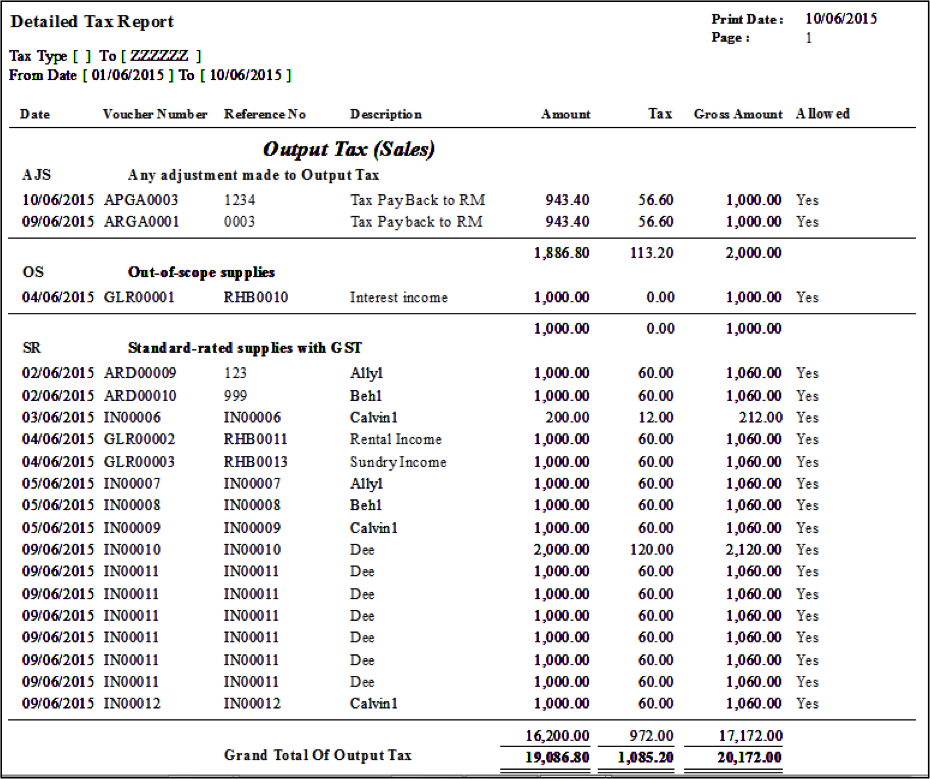

This shows the details of each transaction which are categorised and totalled by tax code. The first page displays the tax codes for Input Tax. The next page displays the tax codes for Output Tax.

This report shows transactions categorised and totalled by tax code, which is similar to the report above. For this report, only output tax codes are included for invoice vouchers.

This report shows transactions categorised and totalled by tax code, which is similar to the report above. For this report, only input tax codes are included.

This report shows transactions categorised and totalled by tax code, which is similar to the report above. For this report, only output tax codes are included.

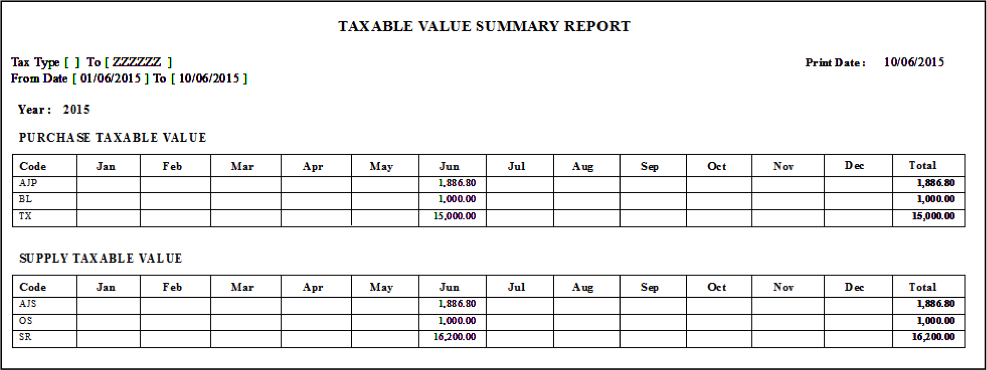

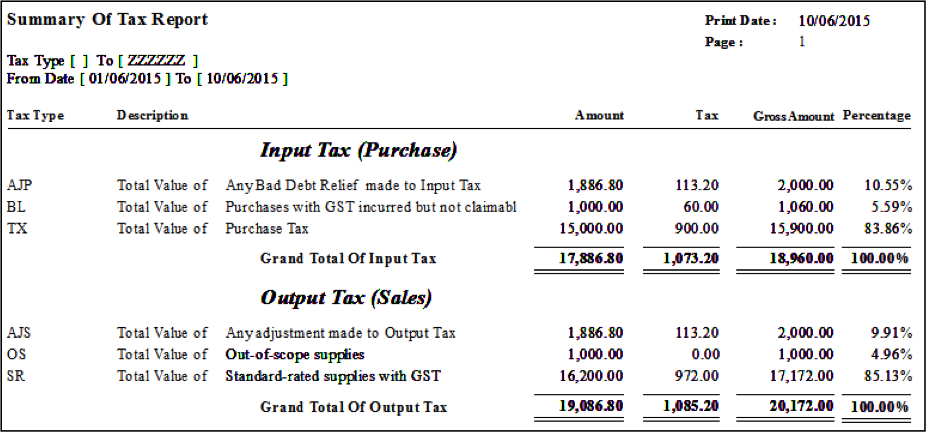

This report shows a summary total for each tax

code.

This report shows the total item amount for each tax code each month. The report is displayed in a landscape (horizontal) format.