GAF or GST Audit File is a computer generated text file that contains GST-related accounting information in a standard format. You are not required to submit the GAF file to Customs for monthly filing. However, you need to provide the Customs with this file for their audit purposes.

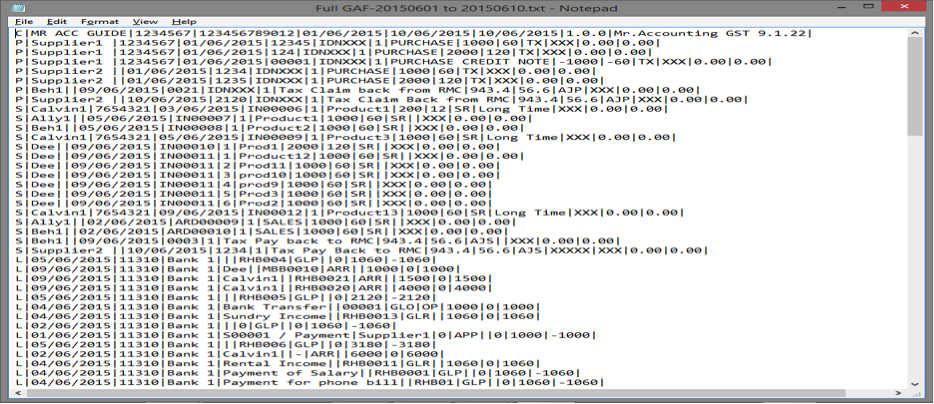

The GAF file consists of C (Company info), P (Purchase

records), S (Sales records), L (General Ledger transaction) and F (Accuracy

checking) records.

In order to generate the GAF file, you first need to set the correct tax codes, and then save sales and purchase transactions into the system. The system automatically picks up this information and processes them into the GAF file.

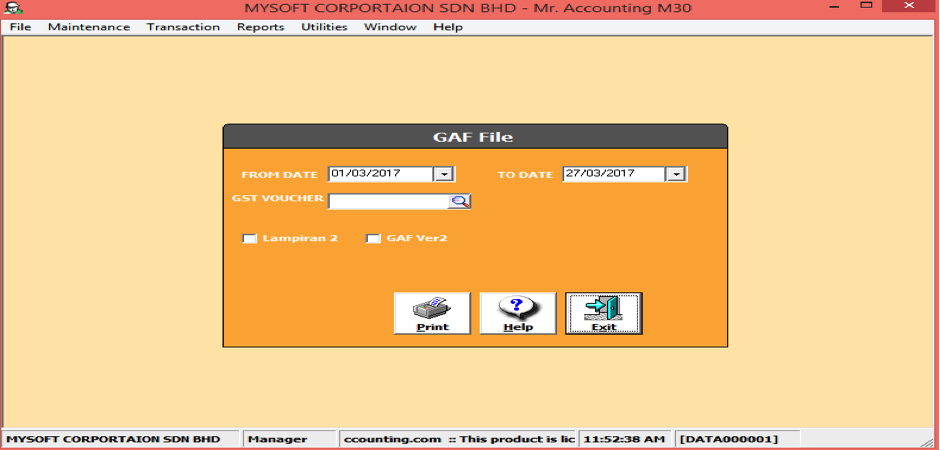

You can use the Generate

GAF file function to generate a

“.txt” GAF file. Currently, our system default GAF version is 1. If users want

generate GAF version 2 and Lampiran 2 you are need to make sure you already

reconcile the GST return first before generating the GAF. Because, GAF version 2

and Lampiran 2 will based on GST voucher no for particular period already

submitted for generate report.

Example: