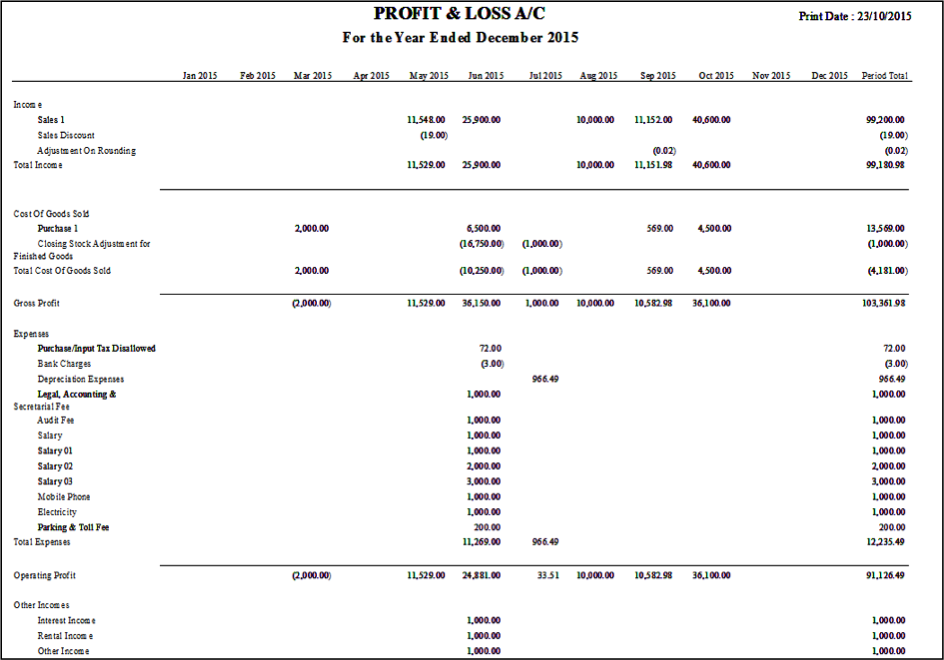

The Profit

and Loss statement

(P&L) of income statement is a summary of the financial performance of a

business over time (e.g. monthly, quarterly or more commonly annually). The

revenues, costs and expenses incurred in the selected period are summarised in

this report. This calculates the profit for the business, and allows you to

assess whether the change in profit is due to a change in revenue, costs or

both.

There are three types of P&L as

follows:

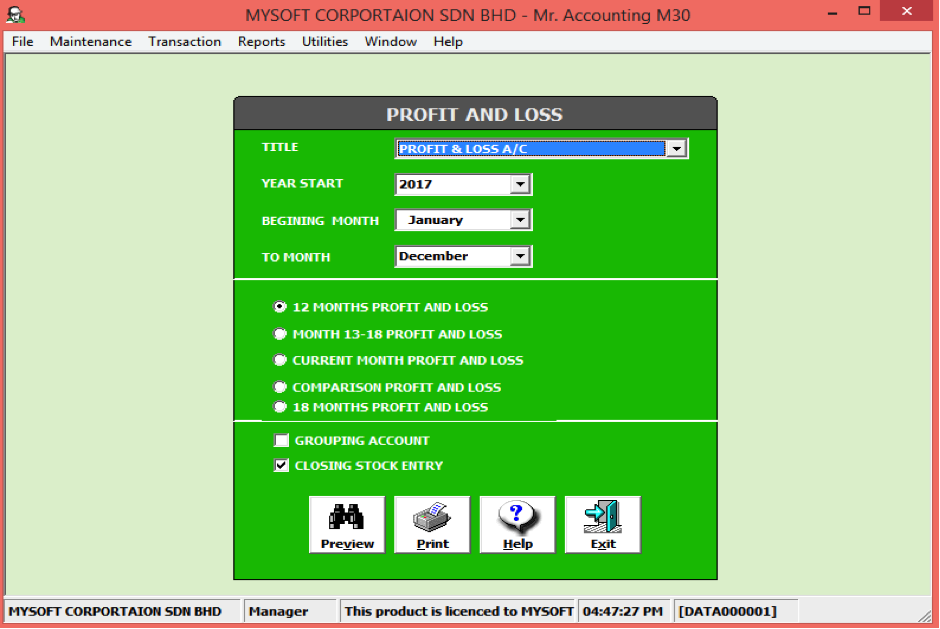

This is the standard format for the P&L statement.

Title: You can edit the title that

appears at the top of the report. Select either “Profit & Loss A/C” or

“Income Statement”.

You can use these shortcuts to

quickly set the period above:

12 Months Profit and Loss: This is the

standard format. The period of the P&L is set to the financial period that

you set under the Company Profile Settings.

Month 13-18 Profit and Loss: The P&L

period corresponds to the period 6 months after this financial period

Current Month Profit and Loss: Set the

period to the current month

Comparison Profit and Loss: This is to

compare the results for a month with another month in the previous

year

18 Months Profit and Loss: This report

allow users to print out P&L for 18 months in single P&L statement (if

your current financial period months 12 and not exits 18

months)

Grouping Account: Tick this to group all sub GL code

balances under one main GL codeProfit or Loss by

Department

You are given an option to filter only transactions by

department [see red box].

You are given an option to filter only transactions by

job [see red box].

Example:

Standard 12 month P&L for this financial

period.