Supplier Master Quick View screen

1.

A

Red

supplier means that

their balance is over the credit limit

Select New

to create new supplier and double click on each supplier to edit their

details.

1.

Double click to edit supplier

details

2. Create new supplier

The

supplier details tabs on top are similar to those in the Customer Master.

1.

Similar to the customer code in Customer Master, this cannot be changed after you have selected Save

2.

The company number

needs to be entered for GST claiming purposes.

3.

To attach a file (e.g.

pdf file about K1 form) for easy access of viewing

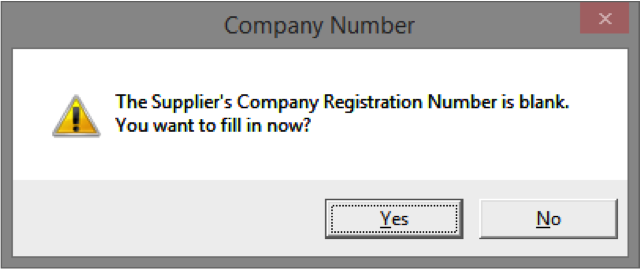

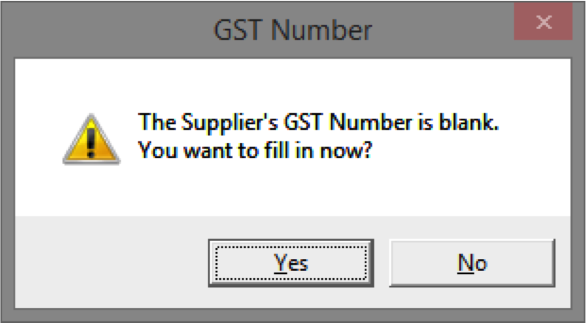

Note: A new window will pop out to prompt you to fill in

supplier company

number if you leave it blank and Save [see below].

1.

Default tax, GL codes, and for salesman, job and department.

2.

GST Number

for supplier and their GST registration date.

Default Settings

Purchase Tax Code: Set the default tax code for

transactions for this supplier [see pg. 54]

Credit Settings

Credit Limit: As per Customer Master, the

credit limit here is the maximum amount of money that is allowed to be owed by

us to the supplier. This is determined by the supplier or our own internal

credit policy. The supplier is listed in red in Supplier Master if outstamding balance

exceeds this.

Terms: You can type whether this supplier

is paid on “CASH” or “CREDIT” terms

Credit Period: Maximum period to receive payment

(this used to calculate “Which supplier do we need to pay by today” in

MIS module). Type C.O.D. (Cash

on Delivery) for a cash-based supplier.

GST Settings

Note: A new window will pop out to prompt you to fill in supplier GST number if you leave it blank and Save [see below].

The Customs of

Malaysia is interested in the company number and the GST registration

number of your supplier. First of all, you can only claim back GST from a

registered trader, therefore there should be a GST Number.

Secondly, the

Customs needs this information to trace back transactions to see if they

actually occurred by matching them with the sales entry of your supplier. Also,

the Customs need to determine whether this transaction is standard rated and

claimable for tax.

The GST

information is less important for our customers because whether we charge GST

depends on our own GST registration status.

This

shows the total invoiced (from Purchase Entry) and

payment

(in Supplier Payment) amount for

purchases for each month, and in the previous and next accounting periods. The

month for invoiced and payment amount is based on the document date

(invoice or payment date).

1.

These months will change based on the accounting period.

Example: 1/6/2015 – 31/5/2016 will make the months

change to June to May

This shows total purchases for each month in this financial period and next financial period. This is used for analysis for management purposes.

1.

Purchases for each month (from Purchase Entry).

2.

Purchases after this financial accounting period (e.g. for

next year).

3.

Bar chart that shows purchases for each month.

This shows all transactions for this customer. It is similar to History button in SupplierMaster.

You can enter additional details and remarks for this supplier here (other than those already keyed in under the Supplier Details tab above).

If you are continuing

your accounts from another software or you first start using accounting software

(i.e. previously you done bookkeeping on paper), you may have outstanding

invoices from each supplier from the previous period.

You should key in

outstanding invoices for each supplier in their respective Opening Balance

tabs.

How to key in outstanding invoices under the Opening Balance tab?

1.

Step 1: Date

is the day before the first day you start using Mr. Accounting.

Example:

Start using 1/4/2015. Date should be 31/3/2015

2.

Step 2:

Enter reference as PINV01, 02 etc (key in all outstanding invoices)

3.

Step 3:

Enter amount

outstanding for the invoices. Press Enter to add the item to the list.

4.

Note: To

delete the entry select the entry and press the Delete key on the

keyboard