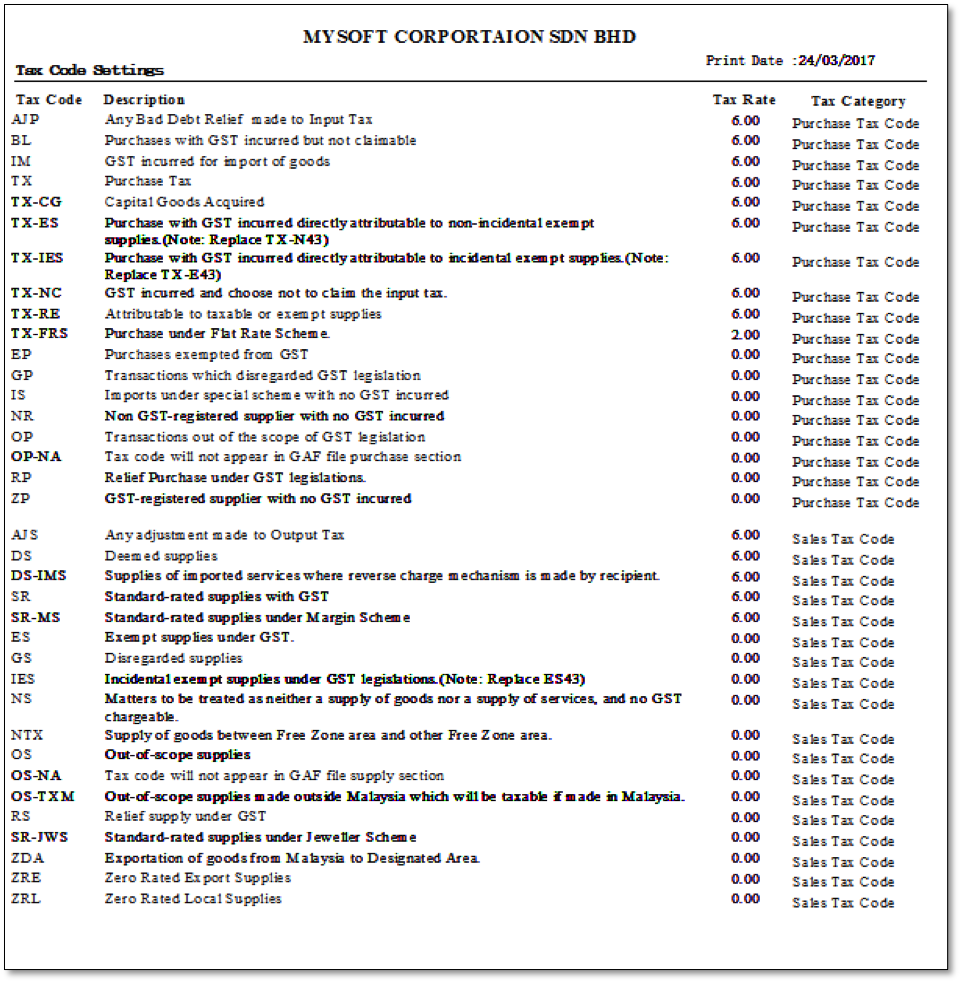

This screen displays the

preset tax codes that are based on the recommendation by the Malaysian Customs.

The tax codes can

be divided into

purchase and

supply tax codes. The tax codes under Both are old tax

codes for Sales and Service tax which should not be used.

The default preset

tax codes, description and tax rates are as below:

Note: Tax codes are only suggested by the

government and used for their tracking purposes. It is recommended to use the

standard tax codes recommended by the government, but the most important thing

is to ensure that the final tax payable/refundable figure is accurate in the

GST-03 Return form.

Tax Settings Quick View screen

1.

Tax Amount: This is the total tax that has not been reconciled

and submitted in the GST Return.

2.

In Use:

see below

3.

Include Submitted Transaction: Tick to include transactions that are already submitted in

the GST-03 form

4.

Transaction: see below

5.

Print a summary of tax

codes details (tax code, description, tax rate, input and output GL code

etc)

6.

Delete the

tax code (be careful

not to delete important tax codes)

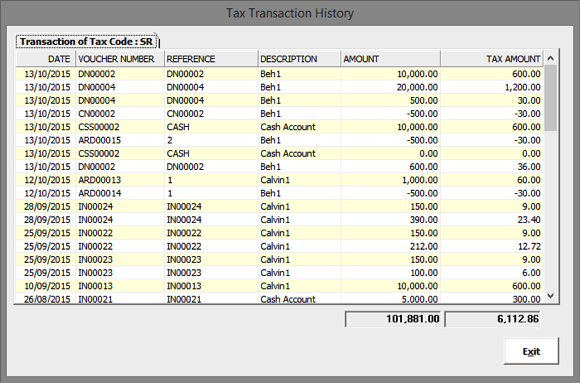

You can use the Transaction button

in the Quick View screen to display a list of all transactions with the selected

tax code. You may need to use this function to check why there is an outstanding

tax amount even after you have reconciled and submitted the GST Return form.

Step

1: Select the tax code that you

want the history for (e.g. SR)

Step

2: Select the date range to be

included

Step

3: Select the Transaction

button

A new window pops

out showing the transaction history for this tax code as below.

Double

click on tax codes or select a

tax code and select Record.

Example:

edit TX tax

code under Purchase Tax

1.

Include in GST Return: Tick to include the amount for this tax code in the GST

Return form

2.

Tax Memo:

This provides an explanation of the tax code

3.

Tax Link to GL: see below

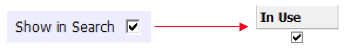

4. Show in Search: see below

Tax

Code: Enter the name of the tax

code

Description: Type in a description that will appear in the Quick View

and in the magnifying glass selection screen

Tax

Rate: This is to configure the

tax rate for this tax code. This is used to calculate the tax amount for

transactions using this tax code. The current rate is 6% for GST chargeable

transactions and 0% for transactions not chargeable to GST.

Tax

Category: This

is to set which field in the GST Return form

that amounts for this tax code are posted to. For example, if you set this to

“GST-Std Rated” and “Supply Tax Type” then this amount is posted to the 5a) and

5b) fields in the GST Return.

Tax

Type: This

categorises the tax code into either purchase or supply. This affects the

transactions that you can tax code under. For example, if you select the Supply

Tax Type, then this tax code can only be selected under sales (i.e.

customer-related) and receipts transactions such as Cash Book Receipt,

Sales Entry

etc.

General Ledger Posting: This

is to set which GL code the amount for this tax code is posted to. This GL code

is a control account for input tax/output tax under 3. Liabilities, or

disallowed from claiming tax account under 7. Expenses.

Note: The GL

posting is not

the same as the tax category field above.

GL posting affects

the GL code for posting tax amounts in the General Ledger, whereas Tax Category

affects which field the amount is posted to in the GST Return form in the GST

module.

Only those Tax Codes

that have been ticked for Show in

Search will show up when you click on the magnifying

glass to select tax codes [see example in Cash Book Payment below].

1.

These tax codes all have “Show in Search” ticked. If not

ticked, they will not show up here.

If Show in

Search is ticked, then the In Use column in the Tax Settings Quick

View screen will be ticked also.

You can use

this function to link a tax code to an income or expense GL code, which means that this tax code

is automatically selected after you select the linked GL code.

Example: Link

the OP

tax code to director fees

GL code (an expense item)

Step 1: Double click on the OP tax code to edit

Step

2: Select GL code [in red box]

to link with the tax Code using magnifying glass (e.g. 71300 Directors Fees)

Note: You

can use the Add and Remove buttons to add and remove GL codes from this

list.

Step 3: Save the transaction

After you have linked the tax code (OP) to director fees

(71300):

When you select

Director Fees as 71300 in GL code in Cash Book Payment, then the

Tax Code will be automatically set to OP.

Step

1: Enter 71300 in GL Code

Step

2: Tax words will be

blue and Tax Code automatically set to OP

This prevents you from using the wrong tax

code for that GL code, and saves you data entry time.