The Cash

Book Payment

transaction is for payment of expenses

which are not trade related. Trade related transactions are done in the

Supplier

module.

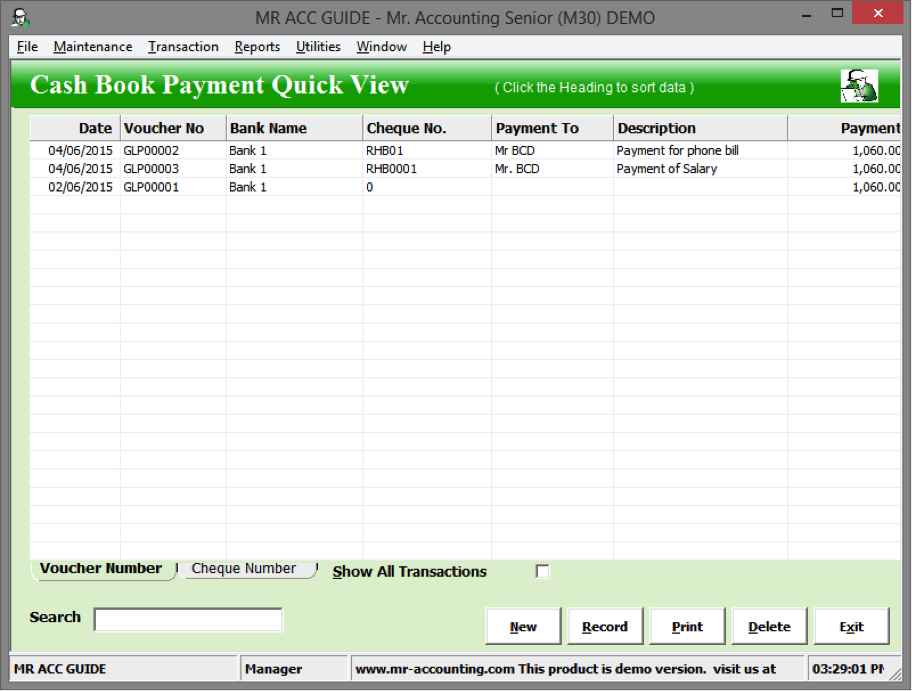

Cash Book Payment Quick View screen

Select New to create new entry

and double click on a cash

book payment transaction to edit.

1.

Details in Quick View screen are from these

fields

2.

The Bill/Ref No and Description fields are picked up from

the Cheque/Ref No and Payment Description fields above

respectively when you click on the field

3.

Users are required key in supplier GST information to meet

requirement set by Custom for claim the GST

Select the Print button from Cash

Book Payment

Quick View screen. A new

window opens as below.

1.

Select format to print [see

below]

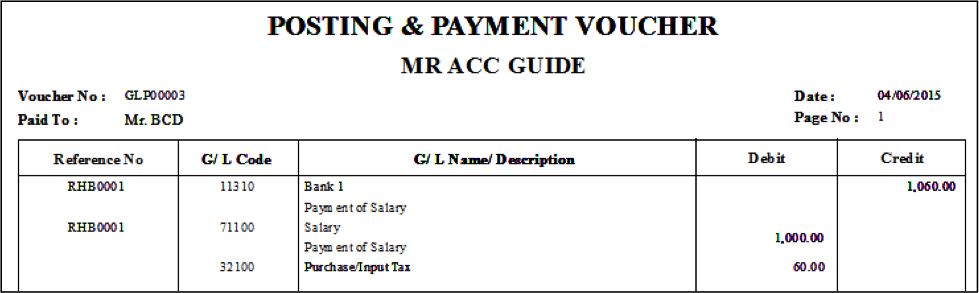

This prints out a voucher containing the debit and

credit double entries.

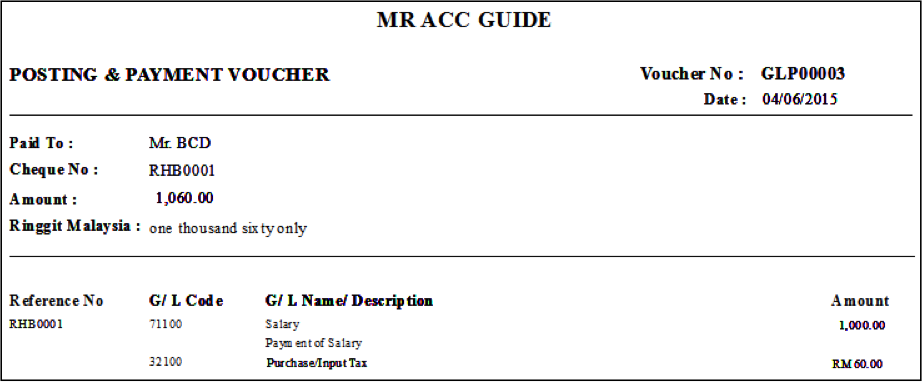

This prints out cheque details followed by

the other debit accounting

entries below.

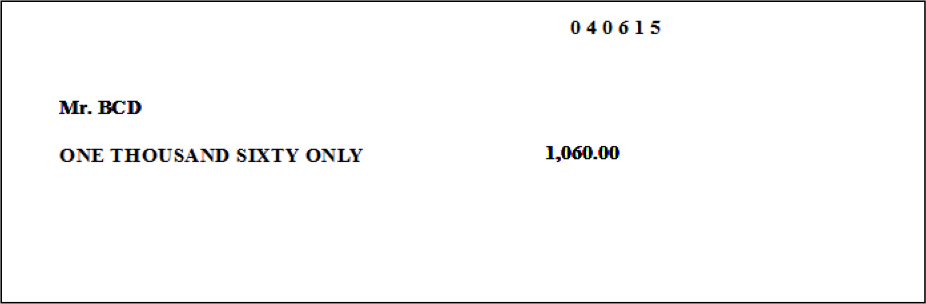

You can select this format to print

the name, date, and amount on a cheque, instead of handwriting the

cheque. The format depends on the Cheque Format that you set for this GL

code.

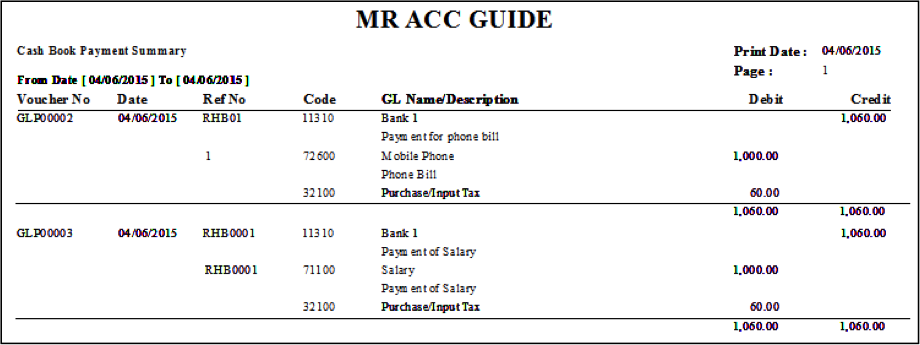

This format displays a summary of double

entries for each voucher no and date. Multiple vouchers are displayed on the

page, instead of only one per page for the debit & credit voucher

format.