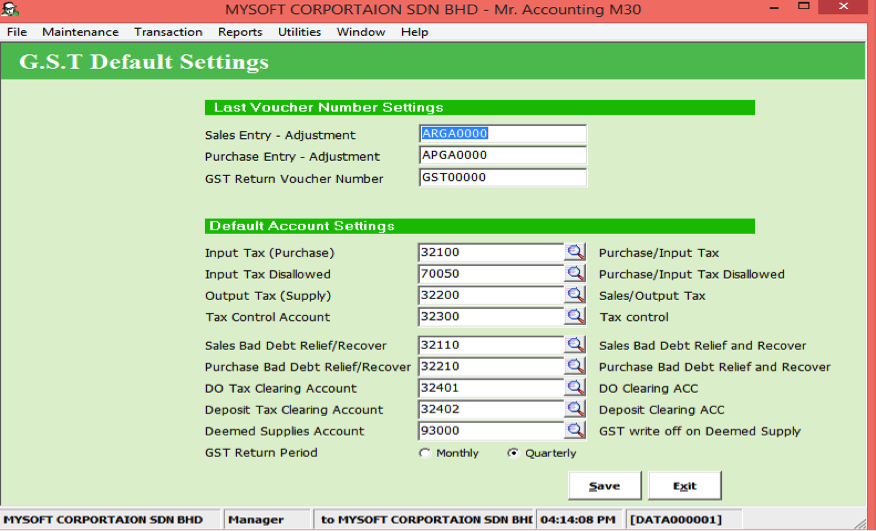

Last Voucher

Number Settings:

You can set the prefix and starting running numbers for Sales

Entry Adjustment and Purchase

Entry Adjustment here. For example, if you

set Sales Entry Adjustment to

ARGA0002, then the next voucher is ARGA0003, ARGA0004

etc.

Default Account Settings

These are to set the

default GL codes to post the double entries for transactions in the GST module,

such as Sales

Entry Adjustment and Purchase

Entry Adjustment.

Note: For data imported from old software, make sure

that the GL codes for the default accounts do not exist already or there

will be an overlap.

Example:

You have already used the 32100 GL code as an accruals account in the old

software.

Solution: You need to create a new GL code for

the accruals

account.

GST Return

Period:

This is to set the taxable period in the GST Return

form. You need to set whether this period is monthly or quarterly (3 monthly).

This period depends on the turnover of your business for the

year.

·

Monthly

: => RM 5mil annual

turnover

Quarterly : < RM 5mil annual turnover