The Sales

Entry Adjustment transaction is used to

adjust the amount of GST tax paid to Customs for sales related transactions.

Note: For transactions in the GST module, only the Tax Amount is adjusted in the general

ledger. There are no postings in the general ledger for Item Amount and Total

Amount.

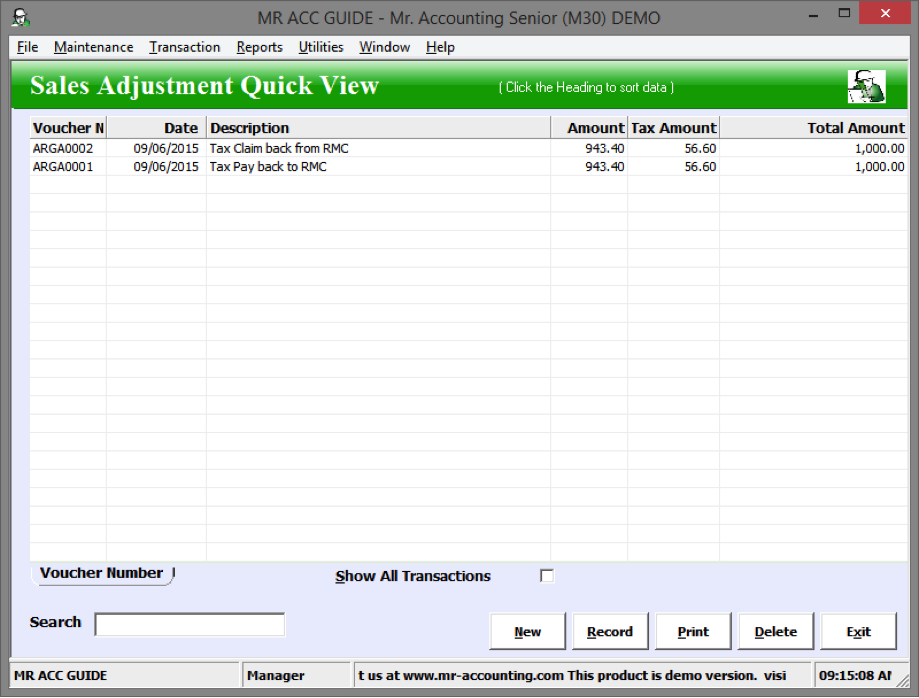

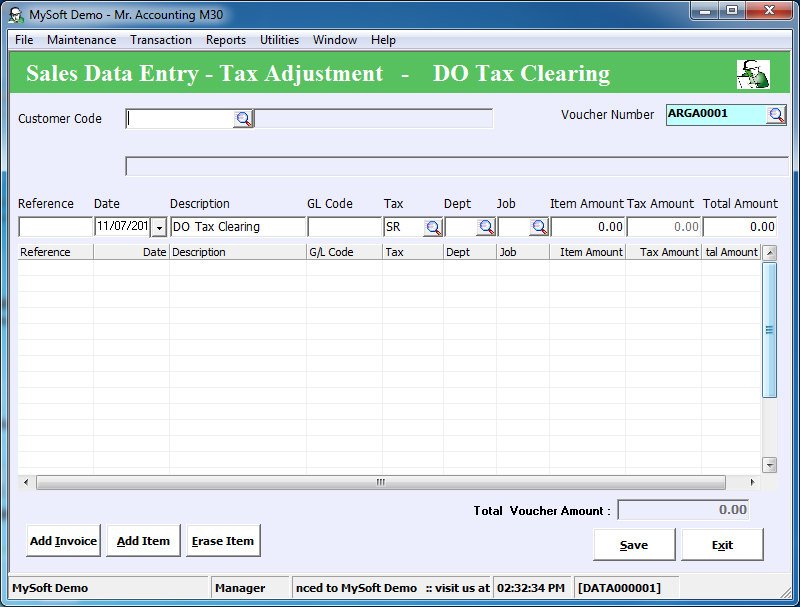

Sales Entry Adjustment Quick View screen.

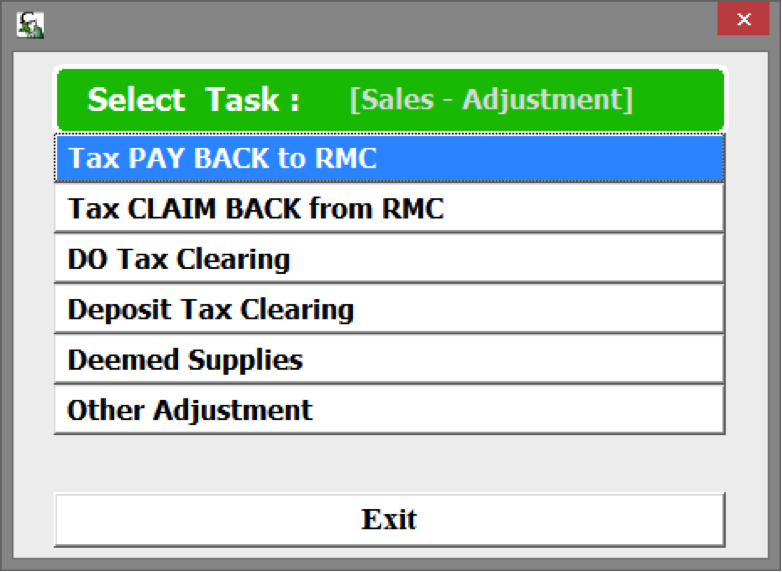

When you click New, you are given options as below.

·

The Tax Pay Back to RMC is

for customer bad debt recovery

·

Tax Claim Back from RMC

is

for customer bad debt relief

·

DO Tax Clearing is for the 21 day

rule to account for GST for DOs that have not been converted into invoices after

21 days

·

Deposit Tax Clearing

is

to account for GST for non-refundable deposits that you receive before you have

invoiced the customer

·

Deemed Supplies is to account for GST

for transactions such as free gifts given and disposal of business assets

without consideration (particularly when input tax has been claimed for their

purchase)

·

The Other Adjustment is for

adjusting GST for other transactions not covered by the above

scenarios

Refer to the examples below for these

scenarios.

Bad debt relief and recovery for the

Malaysian GST purposes is different from bad debt allowance and bad debt written

off for normal bookkeeping purposes.

Bad debt relief in GST is a relief

given by the Customs to provide partial relief for GST paid to the Customs for

customer debt outstanding for 6 months. This adjustment can be made for partial

or full outstanding debt. This reduces the amount of GST you need to pay to the

Customs if there is outstanding debt from customers for at least 6

months.

Similarly, if you recover the debt

from the customer after you have made an adjustment for this transaction, then

it is necessary to make a bad debt

recovery adjustment so that GST is correctly paid to the government for this

transaction.

You can make a bad debt relief

adjustment in the 6th month from the invoice date. For example, we

have invoiced a customer on 15/4/2015, we can make a bad debt relief adjustment

in the 6th month (i.e. in October). It must be done in the 6th month,

not before not after (i.e. not in the 5th or 7th

month).

Example: We have bad debt of 1000 from a

customer. We can make a bad debt relief adjustment in the 6th month

of non-receipt to claim back GST paid for this

transaction.

Select New

→ Tay Claim Back to RMC.

You should key in bad debt in the Total Amount field [in red box], as this

is inclusive tax.

Bad debt recovery

A bad debt recovery adjustment is

made if bad debt is subsequently recovered for which a bad debt relief

adjustment was made. For example, we have made a bad debt relief adjustment as

we have not received payment from a customer in the 6th month. In the

7th month after invoice date, we finally receive payment from the

customer. We should make a bad debt recovery adjustment for

this.

Example: We have made a bad debt relief

adjustment for a bad debt of 1000 from a customer. We recover the bad debt and

should make a bad debt recovery adjustment.

Select New

→ Tax Pay Back to RMC.

You should key in bad debt outstanding in Total Amount [in red box], as it is inclusive tax.

Note: For bad

debt relief and recovery transactions (for customers and suppliers), you need to

do another adjustment entry instead of reversing the first entry. For example,

for bad debt recovery you create another entry with the tax code AJS, instead of

putting a negative amount under the tax code AJP.

A delivery order (DO) will be

converted into an invoice for GST purposes if an invoice has not been issued within 21 days from the

issue of a DO. As the system does not recognise tax for DOs, an adjustment

should be made to account for DOs that have exceeded the 21 days and no invoice

has been issued.

You can check the DO Quick View

screen for DOs that have not been converted into invoices after 21 days or more.

These transactions are displayed in red.

Example: The company has to submit GST

monthly. A DO was issued on 1/4/2015

[in red box]. We perform the calculation of GST Return on 20/6/2015; it is

past 21 days (after 22/4/2015) since

the issue of the DO.

Therefore, we need to make a DO Tax Clearing Adjustment to account for the GST as DO transactions are not posted to the tax ledger (and no GST will appear on the GST-03 Return Form). This DO becomes the source document to charge GST.

Select Sales Entry

Adjustment → New → DO Tax Clearing.

1.

Date: DO issue date 1/4/2015

2.

Item

Amount: 1000

The general ledger postings are as below.

Note: there are no double entries for item amount of 1000.

How to reverse back DO Clearing

Account?

Example:

On 5/7/2015, after confirming the pricing

and other details, an invoice was issued for the DO. The system

will calculate GST you

need to pay to Customs when you create the

invoice.

Therefore, the DO Tax Clearing

Account needs to be cleared otherwise GST will be counted twice and we will

have to pay more GST.

Select Sales Entry

Adjustment → New → DO Tax Clearing.

Note: Make sure to put a negative sign in front of the amount to

reverse out the DO Tax Clearing account.

The double entries show that the DO

Clearing account has been cleared back to 0 balance after reversing the DO

Clearing Account.

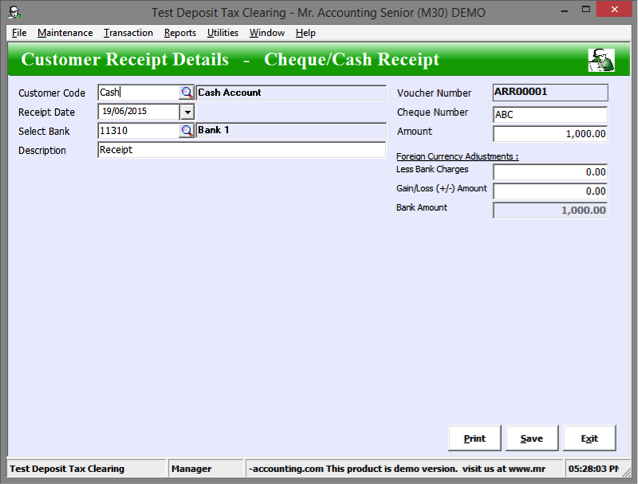

This is used to provide for GST for non-refundable deposits we received in cash from

customers, which have not been

invoiced.

Note: The 3 tax points are receipt of cash, issue of DO and issue

of invoice.

You need to make an adjustment to account for GST for the receipt

of cash.

Example: We received a

non-refundable deposit of

1000 from a customer on 19/06/2015,

when we calculate the GST Return on 20/08/2015 we have not invoiced them for any

amount.

Select Sales Entry

Adjustment → New → Deposit Tax Clearing.

1.

Date: date of deposit

receipt 19/06/2015

2. Item amount: 1000

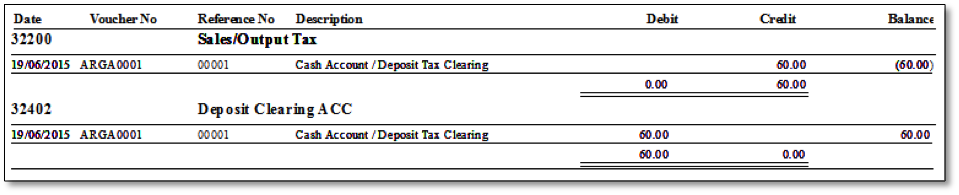

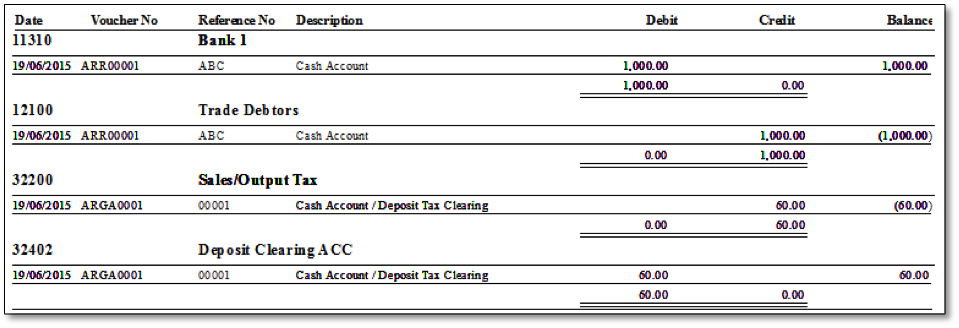

The double entries are as

follows:

Later on 5/9/2015, we invoice the customer for

the full amount.

At this point, the clearing account

needs to be cleared otherwise GST will be double counted and we will need to pay

more GST.

Select Sales Entry

Adjustment → New → Deposit Tax Clearing.

1.

Item

Amount: -1000 (with a negative sign in

front)

After creating the reversal entry, the double entries show that the clearing account has 0 balance [red box].