The Purchase

Entry Adjustment transaction is used to

adjust the amount of GST tax paid to Customs for purchase related transactions.

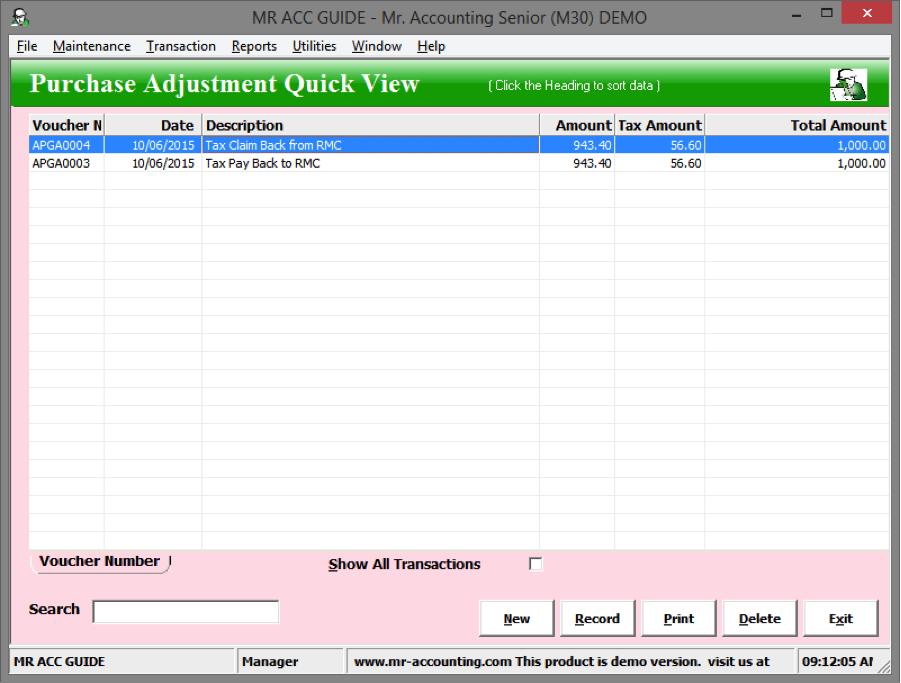

Purchase Entry Adjustment Quick View screen.

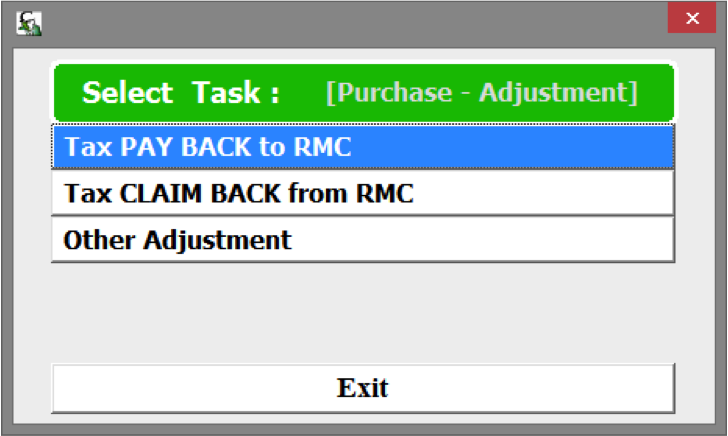

When you click New, you are given options as below.

·

The Tax Pay

Back to RMC is for supplier bad debt

relief

·

Tax

Claim Back from RMC is

for supplier bad debt recovery

·

The Other

Adjustment is for adjusting GST for other purchase transactions not covered

by the above scenarios (e.g. import of goods or import or

services)

Similar to customer bad debt relief and recovery, this

is a GST adjustment instead of an accounting

transaction.

For supplier bad debt relief, the adjustment is done

in the 6th month from the invoice date for outstanding payments to

suppliers. It is necessary to make this adjustment because the Customs also

allows bad debt relief for customers. This must be done in the 6th

month, not earlier or later (i.e. not in the 5th or 7th

month).

Example:

We have not paid 1000 to a

supplier. In the 6th month after invoice date, a bad debt relief

adjustment must be made, as we have to pay back tax to

Customs.

Select New

→ Tax Pay Back

to RMC.

The total bad debt relief should be entered in the

Total Amount field [in red box] as this amount is inclusive tax.

We made a supplier bad debt relief

adjustment in the 6th month of non-payment to a supplier.

Subsequently, we pay the supplier to settle our debt. We should make a bad debt

recovery adjustment to recover tax from the Customs, otherwise tax is paid twice

to the Customs.

Example: A bad debt relief adjustment was

made for 1000 of debt. We subsequently pay back the 1000 of debt, and we should

make a bad debt recovery adjustment.

Select New -> Tax

Claim Back from RMC.

Total bad debt recovered should be

entered in the Total Amount field

[in red box] as it is inclusive

tax.