The GST-03 return is a form to fill

in your GST return details and is submitted to the Royal Malaysian Customs

department. In the ERP software, the values for input and output tax and the

values for tax codes can be automatically calculated based on the transactions

entered in the system.

The form consists of 4 sections and

contains 19 fields to enter the values for tax codes. In Malaysia, the Customs

and Inland Revenue departments are split unlike Singapore in which they are

merged. This form is specifically designed to cater to the Customs department

needs (not Inland Revenue).

GST Return Quick View screen.

1.

Reconcile: [see below]

2.

Submit: [see below]

3.

Print GST TAP

file: [see

below]

4.

Status here can divide to 3

categories:

I.

Read reconcile mean don`t have any

transaction admen by users after generated the GST return for

preview.

II.

Trans. admen mean got some transaction

already admen by users after generated the GST return for preview. So, users

need recalculate the GST return.

III.

Complete is the GST return already do the

reconcile in system.

5.

Select New to create a new GST Return entry

[see below]

6.

Select

Print to print out details for this

entry [see below]

Select New to create a new form

or double click on an

existing GST-03 form to edit.

Note: you can only edit GST-03 forms that have not yet been submitted.

1. Amendment

checkbox: Tick this checkbox to

resubmit an amended form. This is for big changes to the GST Return. For small

changes, you should do an adjustment in the next

period.

2. Voucher

number: This is for internal reference and has the prefix

“GST”, and less important from the Customs point of view. This cannot be edited

using Backspace and cannot be reversed (i.e. the running number cannot be rolled

back).

3. GST

No: This is a 12-digit number

which you get after registering the company for GST. Take note of this number as

you may have to manually enter this at the

bank.

4. Start

Date: The starting date for the

selected taxable period.

End

Date: This is calculated

automatically after you enter the start date based on the taxable period

(monthly or quarterly) set in Default

Settings in the GST

module.

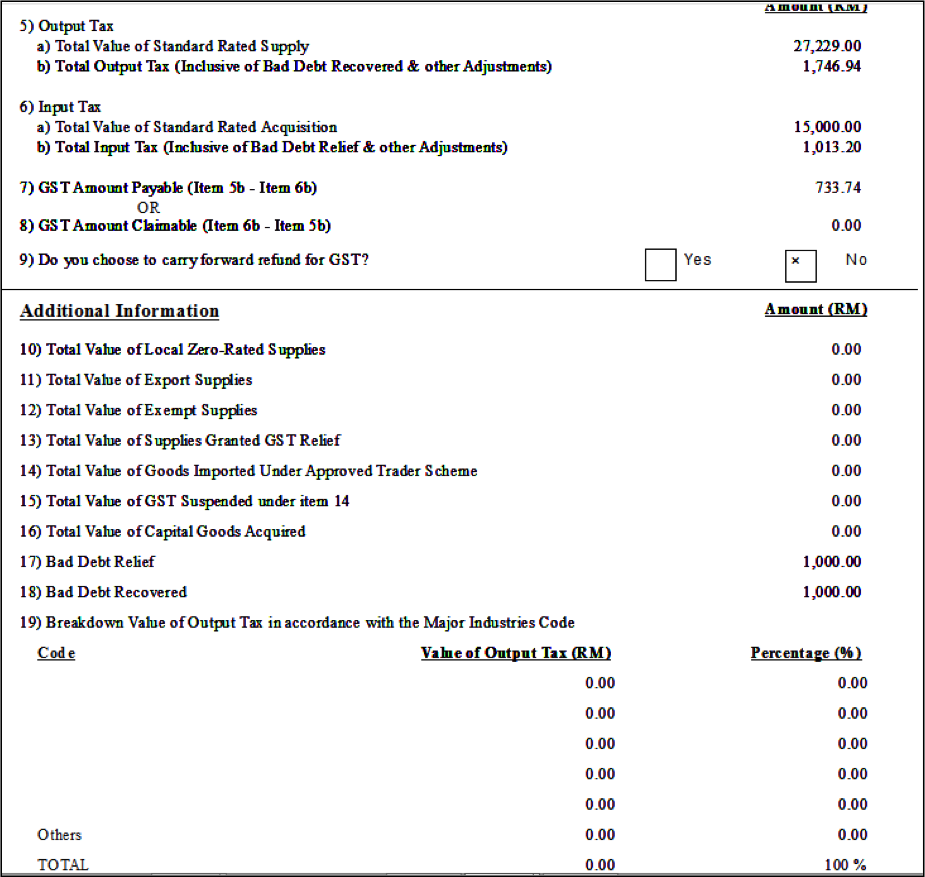

5. Output Tax: This includes the sales

and some other amounts for the following tax

codes:

·

5a) & 5b): Tax codes SR,

DS

·

5 b) only: Tax code

AJS

Notes on DS (deemed supplies):

GST is payable on free gifts for

amounts exceeding RM500 per customer per year. The condition is that the free

gift is given without any consideration. Deemed supplies is also applicable for

disposal of fixed assets without

consideration.

The workaround is to give

free-of-charge (FOC) items in the same sales invoice so that the free gift is

not “without consideration”.

6. Notes button:

Select this button to show the

additional notes as per the actual GST-03 form [in red box] (scroll down to

see).

You can select the Next button to go to Page 2 of the GST Return form [see

below].

7. Calculate

:

The red Calculate button is to automatically

calculate tax amounts. It will be hidden after you select

Submit.

8. Due Date:

Due date is automatically calculated as 1

month from the end date

9. Next: Go to next

page

10. Exit: Go to next page

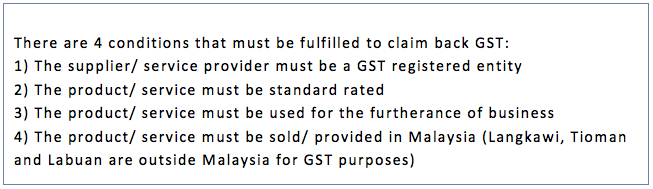

1. Input tax: This includes the purchases

and other amounts for the following tax

codes:

·

6a) &6b): Tax codes TX, TX-CG,

TX-E43, TX-N43, TX-RE, IM

·

6 b) only: Tax code

AJP

2. GST amount payable or claimable: This

is calculated as the difference between input tax and output tax in item 5b) and 6b).

3. Do you choose to carry forward refund for GST: Make a note to the

Customs on whether to refund GST this period (if there is GST refundable, i.e.

input tax > output tax for this period), or carry forward this refund to set

off against GST payable for next period. This figure will appear in the TAP file.

Yes = carry forward, No = refund

GST

You can refer to the guides available

on our website for how to use Mr Accounting to record import of goods and import

of services.

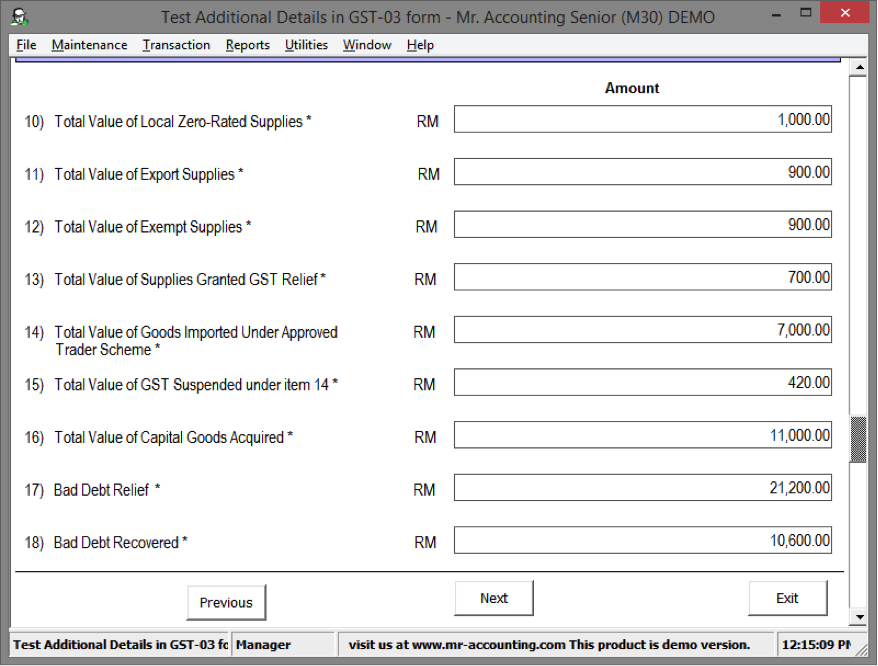

You can scroll down this page to see Part C: Additional Information which

contains fields used for the Custom’s audit

purposes.

Refer to the table below for which tax codes goes into

these fields:

|

Field No |

Which Tax Code and

Amount |

|

10) |

ZRl

& NTXItem

Amount |

|

11) |

ZRE

& ZDA

Item Amount |

|

12) |

ES

Item Amount |

|

13) |

RS

Item Amount |

|

14) |

IS

Item Amount |

|

15) |

IS

Tax Amount |

|

16) |

TX-CG

Item Amount |

|

17) |

Bad debt relief (value including GST; outstanding;

debtor only) |

|

18) |

Bad debt recovered (value including GST; payment; debtor

only) |

Notes on Tax Codes in Part

C:

13) GST

Relief: The relief tax code (RS)

should be used for example when selling medicine to Government hospitals, and

giving goods to charity.

Therefore, the relief tax code depends on who you sell

the goods to. For medicines, it will be a relief item if it is sold to the

Government and standard rated when sold to the

private.

14) Approved

Trader Scheme: Since these approved

traders don’t need to pay GST to Customs for importing, there is no claim under

the tax code IS.

15) This is hard

coded as 6% of item 14).

16) The value for

the TX-CG tax code will be in 6a)

& 6b) as well as in 16). An example is the purchase of a

commercial vehicle for the company’s use.

Note: If the vehicle is bought for a director it will

be under the BL tax code to prevent tax evasion. Also, if the commercial vehicle

is subsequently disposed without consideration, then it will be treated as a

deemed supply with the DS tax code.

17) &

18) Bad debt relief and recovered: It is

compulsory to perform a bad debt adjustment in the 6th month

after the first transaction and not after or before that. This is

because it is easier Custom officers to check that adjustments are performed in

the 6th month using an ageing

report.

Note: If a credit note has already been issued to

write off bad debt, then this adjustment need not be

performed.

Select Next to go to

the next page in the GST Return (Page

3).

Item 19) the MSIC codes are industry codes that are

assigned to you when you register your business for GST. The Customs department

matches the general pattern of output tax of your industry with your data to

check for anomalies which might trigger an audit.

If these codes are not filled in, an

exception report might be triggered by the Customs audit.

1. MSIC Code: Enter the Major Industry Codes (MSIC) that

are applicable to your sales.

2. Value of Output Tax: This is the value

of output tax only, not the total sales figure. (e.g. 60 not 1060). The total

output tax is usually equivalent to the value of 5b), unless there are GST

adjustments made to this figure.

3. Percentage: Calculate the percentage

for each MSIC code here.

Scroll down to

see Part D: Declaration on Page 3 of the GST Return

form.

1.

Here, key in the authorised person’s name as per IC.

This person will be responsible for the accuracy of this GST-03 and held

accountable by Customs.

2.

Fill up the

additional details for this person here.

3.

Save the details of this GST-03 form

4.

Print out the actual GST-03 form to mail or submit at the counter at

Customs

Select Print from the GST

Return

Quick View screen to print out the summary

for amounts in the GST Return Form [see example

below].

You need to reconcile the GST Return Form before you

print and submit the form to the Customs. This puts a ‘flag’ on these transactions,

so that they are excluded from future GST-03

forms.

Also, the reconcile

function posts GL double entries

that move input and output tax into a tax control clearing account. You should

create a Cash

Book Payment transaction that pays tax

into this tax control account GL

code to clear the account.

For GST audit and compliance purposes, these

reconciled transactions that have been ‘flagged’ cannot be deleted or edited. Therefore, make sure

your data is entered correctly and there are no missed transactions

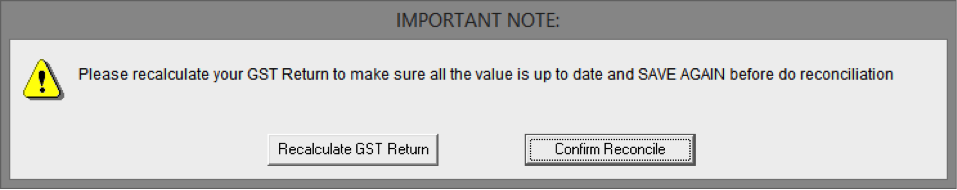

Select the Reconcile button and a new window will

pop out as below:

Select Recalculate GST Return to go back to

the GST-03 form page to recalculate the input and output tax if you have edited

the transactions. Select Confirm

Reconcile to confirm the reconcile process [see below

window].

After selecting Confirm Reconcile, the following window

will pop out:

1.

Select the tax GL

codes here. The amounts in the input and output tax codes are posted into the

tax control GL code.

2.

Date: Set the date to the last day of taxable period

3.

Description: Check to make sure the

period is correct

4.

The double entries for these transactions

can be seen here.

5.

Type in a remark

here

6. Save and complete reconciliation

After you have successfully submitted

the GST Return to the Customs (via online submission on the TAP account or

manual submission at the counter or by mail), you can use the Submit function is to make a note in the system

that the GST return has been submitted.

After submitting, this prevents further amendments and deletions to that GST return

entry. The submit function is only possible after reconciling that

GST return.

Example:

a. The Reconcile column shows a date if

reconcile was done previously

Step 1: Select the GST

return

Step 2: Select the Submit button (a new window

opens)

Step 3: Select Yes in the new window

Step

4: The submitted checkbox is ticked. This makes a

note that this form has been submitted.

You need to generate a TAP file for online submission

of your GST return. The amounts in the 19 fields of the GST-03 form are

converted into a text file format. You can login to the TAP on the Customs

website to upload the file there to submit.

Example:

Step 1: Select the GST

return

Step 2: Select the Print GST TAP file button (a new window

will open)

Step 3: Select Confirm Generate TAP

file

This new window below will

open.

Step 4: Select the directory to save to (e.g. create a new

folder called TAP file on the Desktop)

Step 5: Select Save