As mentioned in Fixed

Asset Register before, you need to first

create a category in Fixed

Assets Category before you are able to

create a fixed asset in Fixed

Asset Register. This helps categorise

and filter fixed assets by their category in the reports. Also, the depreciation

method used and amount charged are based on the fixed asset

category.

Fixed Assets Category Quick View screen

1.

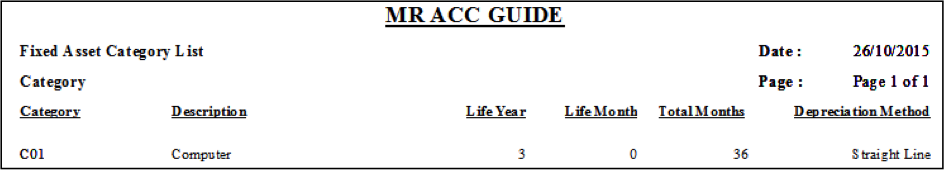

Print: You can select a category and then select Print to display a fixed asset category

list and their details [see example below]

Example: Print fixed asset category

list

Note: You can only print one category at a

time

Select New to create a new fixed

asset category and double click to edit

category details.

1.

These details are

picked up in the Fixed Asset

Register, after you select the fixed asset

category

2.

You can set disposal GL

codes in product category which will be used when you make a disposal

transaction (optional)

Category Code: This has maximum length of

10 characters (letter or numbers)

Category Description: You can enter a

brief description for this category here

Asset Life: Enter the life of this fixed

asset when bought in Year(s) and Month(s)

Yearly Depreciation Rate: This is the

percentage of depreciation charged per year

Depreciation Method

Straight

line: Constant depreciation

charged as a percentage of the fixed asset cost

price

Reducing

balance: Depreciation is charged

as a percentage of the residual value (after depreciation value) of the fixed

asset. This pattern is for fixed assets that undergo technological obsolescence

relatively quickly, such that usage in early periods result in higher

depreciation

Written

off: This flags the fixed

asset as ‘written-off’. No depreciation is charged after being flagged. You need

to create a separate Disposal transaction if

you are selling off the fixed asset.

Reducing

balance LCCI: Depreciation is

calculated as a percentage of the monthly residual balance of the fixed asset,

not the yearly residual balance

Balance Sheet

Accum Depre: Set the contra fixed

asset accumulated depreciation GL code (2XXXX).

Profit Loss Depr. Charge: Set the depreciation charges GL code (7XXXX).