The Fixed

Asset Register is considered as a master

file that stores the detailed information for fixed assets, similar to Customer

or Supplier

Master.

This module only stores

information for fixed assets that you have already bought. First, you need to

create a purchase transaction for the fixed asset. You can use Purchase

Entry in the Supplier

module to create a

purchase transaction.

Note: Before creating a

fixed asset here, you need to create a category under Fixed

Assets Category

first!

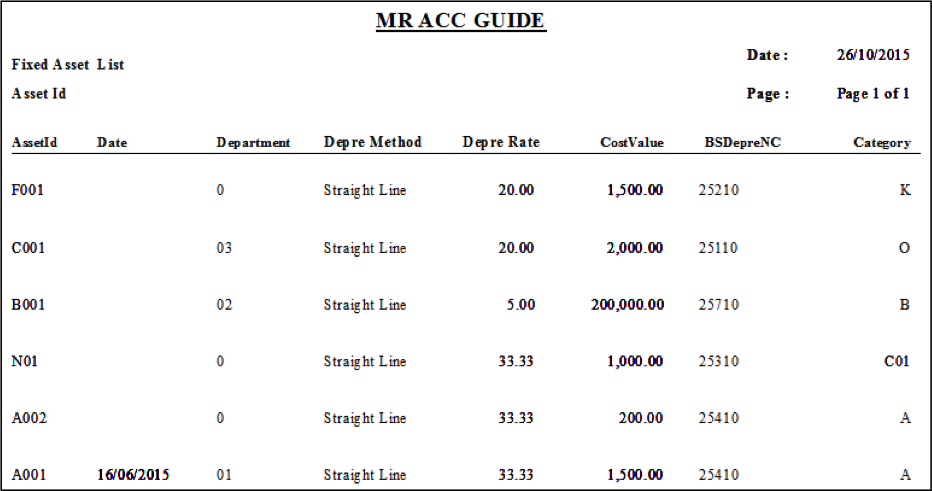

Fixed Assets Register Quick View screen.

1. Print: This is to print out a fixed asset list and their details [see example below]

Example: Print fixed asset

list

Select New to create a new fixed

asset and double click on a fixed

asset to edit details.

1.

You can Add and Remove an image for this fixed asset

2.

Depreciation

Method and Asset Life are selected automatically based on Asset Category

Asset

Code: This is a unique code

that is 20 characters (numbers or letters) long. Similar to customer code,

supplier code etc, you cannot change this code after you have saved

it.

Asset

Name: Type in the name of the

fixed asset here

Description: You can enter

other details about this fixed asset here

Asset

Category: You need to create

categories under Fixed

Assets Category first before you can

select them here. This is used to categorise and filter fixed assets in reports.

The depreciation method and percentages are also recorded based on the fixed

asset category.

Link Asset

Code: You can link this asset

to another fixed asset. For example, the linked asset might be an add-on to this

asset, like a printer to a computer etc.

Supplier: You can create

a supplier in Supplier

Master and select them here to

keep a record of the supplier you bought this fixed asset

from

Date of

Purchase: Refer for the date of

fixed assets acquisition(for new assets) for the existing fixed assets users

just key in the last date of latest depreciation date example 31 December

2016.

Department and

Job Code: Just like category, you

can set a department and job code for this fixed asset to help filter and

categorise the fixed asset in reports

Last Service Date and Next Service Date: Keep a record of servicing history for this fixed asset

1.

Set the Credit entry to an accumulated

depreciation GL code (2XXXX). This is a contra fixed asset

account.

2.

Set the Debit entry to an depreciation expenses

GL code (7XXXX).

3.

Depreciation

rate is the percentage of depreciable value

depreciated per year

4.

Depreciation to

Date is the amount of accumulated depreciation to

date

Cost

Price: This is the cost price of

the fixed asset. For the purposes of depreciation, this should be exclusive of

GST.

Residue

Value: This is the remaining

value of the fixed asset after it is fully depreciated. In accounting terms, it

is the Cost Price less Depreciable

Value.

Depreciable

Value: This is calculated automatically as the

difference between Cost Price and Residue

Value

Net Book

Value: This is calculated automatically based on Cost Price – Depreciation To

Date

Next

Depreciation: This is the depreciation

amount that is calculated next period

(month)

Date Last

Posted: This is the date of the

last (most recent) depreciation posting using the Month

End Transaction

screen

Disposal Date: If you have created a disposal transaction under Disposal screen, then the date of this transaction is showed here

Capital allowance refers to sums of

money that you can deduct from the overall corporate or income tax on its

profits, derived for example from purchase and use of fixed (non-current)

assets.

In Malaysian tax, you can claim a

one-time allowance for the first year (usually at a higher rate than annual

allowance) called an initial

allowance for fixed assets and written down allowance or annual

allowance for subsequent years which is the annual rate in which capital

allowances can be claimed. The written down allowance can be reduced or extended

if the chargeable period is shorter or longer than a

year.

You can keep a record of capital

allowances in this tab for your tax claiming purposes. There are no GL postings

from this tab.

1.

Key in the total amount

of cost that qualifies for claiming

capital

allowances

2.

The amount of capital

allowance claimed

3.

The balance of qualifying capital expenditure

claimable

4.

The Amount is calculated automatically after you enter

the Tax Qualified Cost and Percentage

Enter additional details about this fixed asset not

entered under the Fixed Assets Code

Details tab.

Insurance

You can enter the name of the

insurance policy for this fixed asset and the date of renewal of the insurance

policy.

Memo

There is space to enter additional details

for this fixed asset.