What is koperasi?

Koperasi is an autonomous business unit which members voluntarily

unite to achieve common interest in economic, social and cultural rights,

through an entity jointly owned and democratically controlled.

Example of Koperasi in Malaysia includes Bank

Rakyat.

Benefits of Using Member

• Manage the relationship of the koperasi

members- This module is hereby to help you to separate your suppliers

and customers within your koperasi clearly.

• Simplify the complex transaction within your

koperasi members- As your customers can be your suppliers at the same

time in a koperasi, this module allows you to group up your suppliers and

customers according to different document types as

decided.

How Member Works?

Step

1: Setup Member

Information and opening balance under Member

Master.

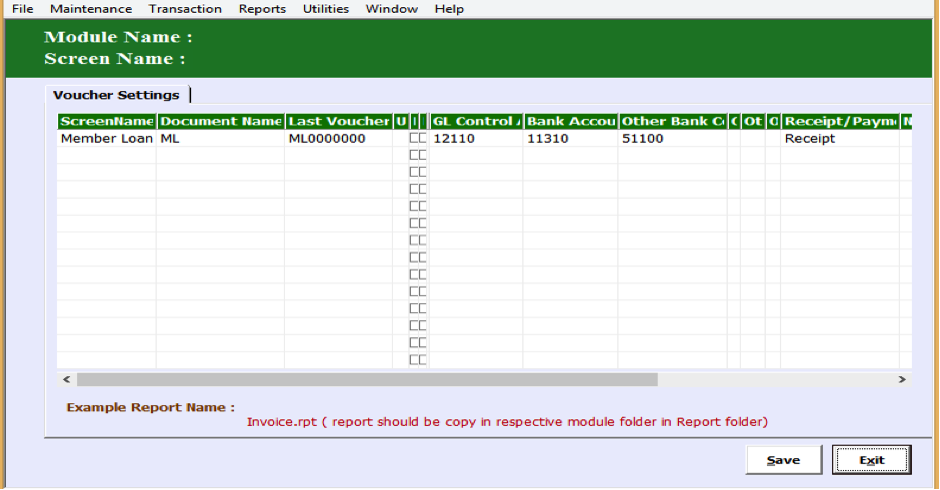

Step 2: Setup multiple

receipt and payment in a single transaction by login to Task

Settings.

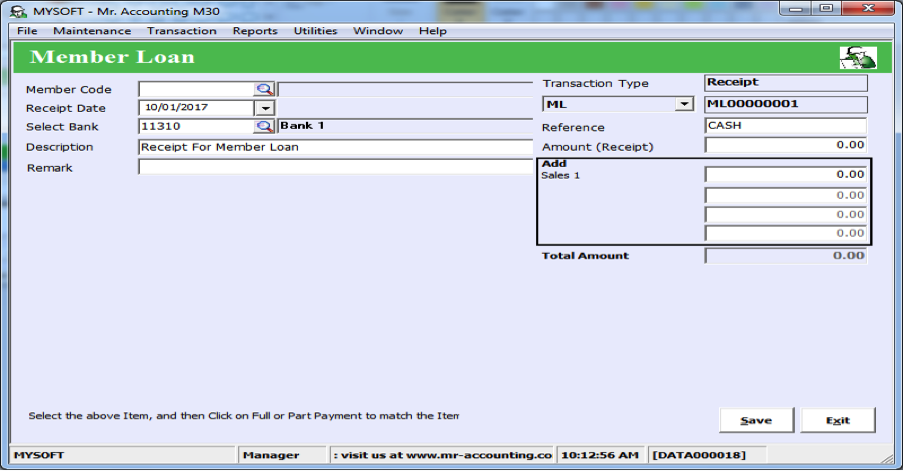

a)

Example for receipt: Receipt from Member

Loan

Member control account GL code:

12110

Bank account receive GL code:

11310

Add additional charges: Current month Interest receive GL code:

51100

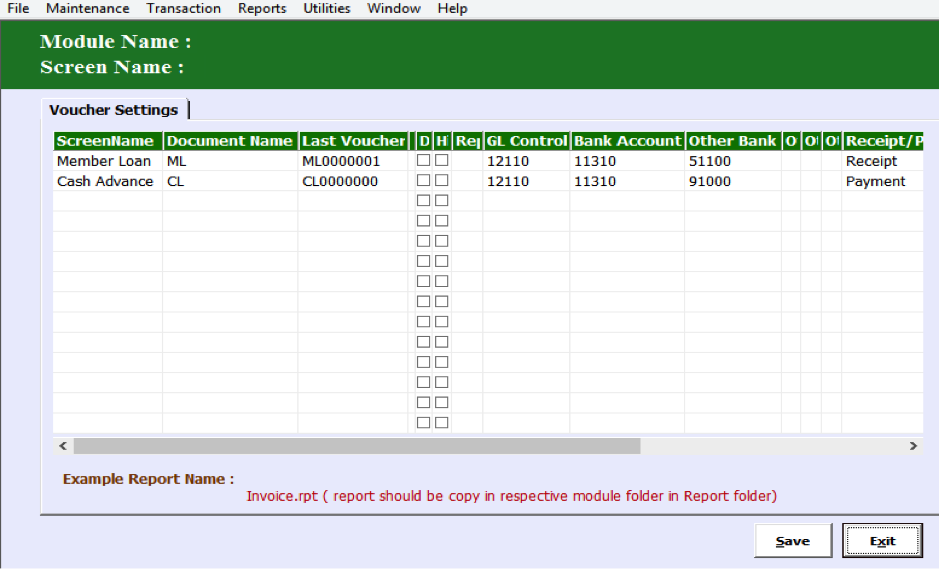

b)

Example for payment: Loan given by Co-operation to Member under a

Cash Advance Scheme

Member control account GL code:

12110

Bank account payment GL code:

11310

Less additional charges: Disbursement – Legal Fees: 91000

Step

3: Generate multiple receipts and payments under

single transaction (screen name).

Example

1: Loan Repayment from

member.

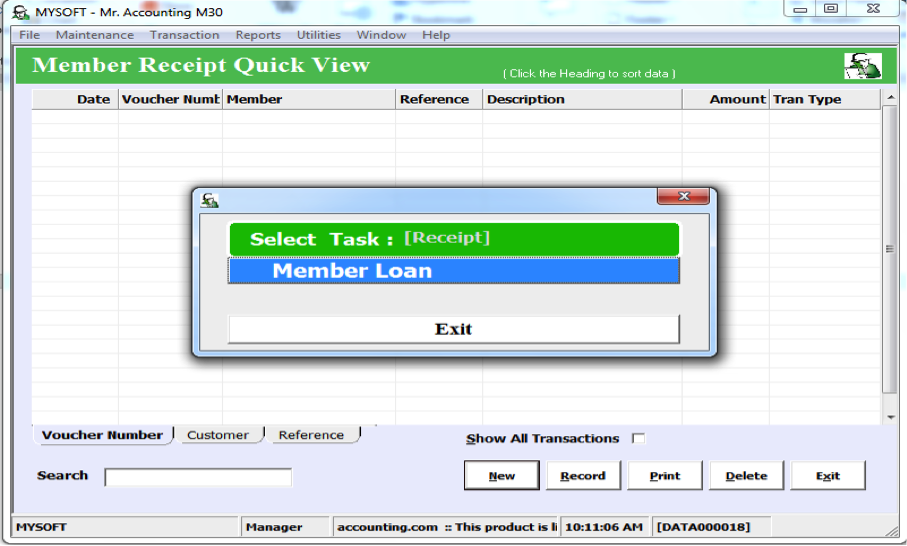

First: Create Member Receipt by click the

Receipt button

Second

: Choice Member

Loan.

Third: Choice Member Code how make

repayment and divide the total receipt amount consist principle and

interest.

The member report column is the same with Mr. Accounting

Customer Reports.