You can use the Recurring function to

automatically post transactions that recur (repeat) every month. The recurring

transactions are saved and you can post them with a press of a

button.

Recurring Quick View screen

1.

Transactions: see

below

2.

Process: see

below

Select New to create new entry and double click on each transaction to edit their details.

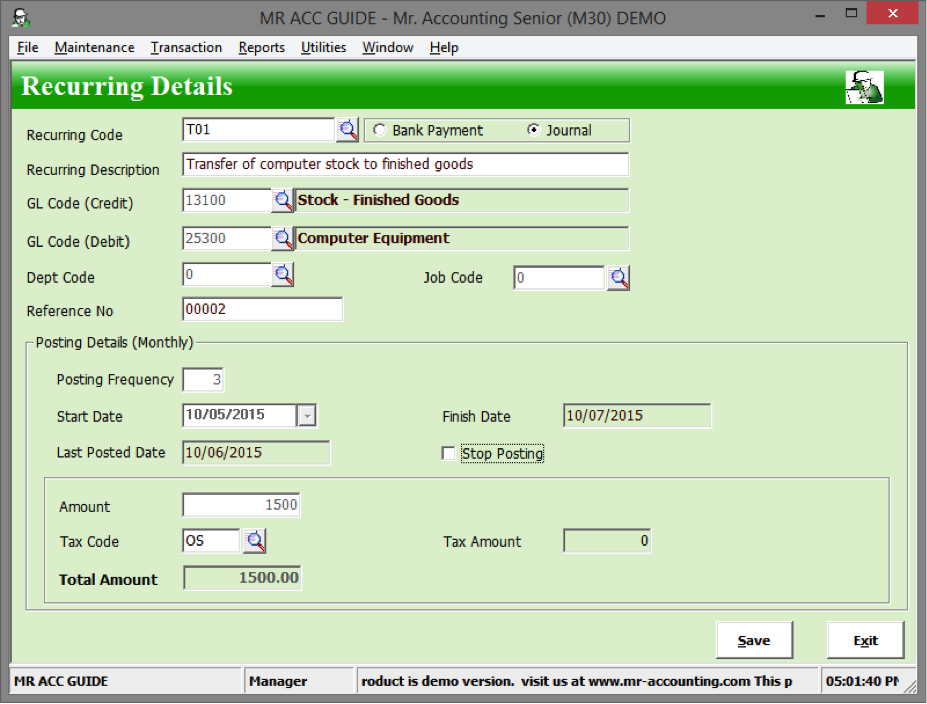

Recurring Code: You can set a code to be

used for the recurring transaction

Recurring Description: Enter a brief

description for this transaction

GL Code (Credit): Select the credit entry

posted

GL Code (Debit): Select the debit entry

posted

Dept Code and Job Code: Select the

department and job code to be used

Reference No: Enter the internal

reference no

Posting Details (Monthly)

Posting Frequency: How many times is this

recurring transaction posted?

Start Date: Set the date of the first

posting

Finish Date: The finish date is the date

of the last posting. This is based on the posting frequency after the start

date

Last Posted Date: This is the date of the

most recent recurring posting

Stop Posting checkbox: If you tick this, then the transaction does not show up in the Process button

Amount: Enter the amount of the recurring

posting transaction

Tax Code: Select the appropriate tax code

for this transaction

Tax Amount and Total Amount: These are

calculated automatically based on the amount and tax code that you have

entered

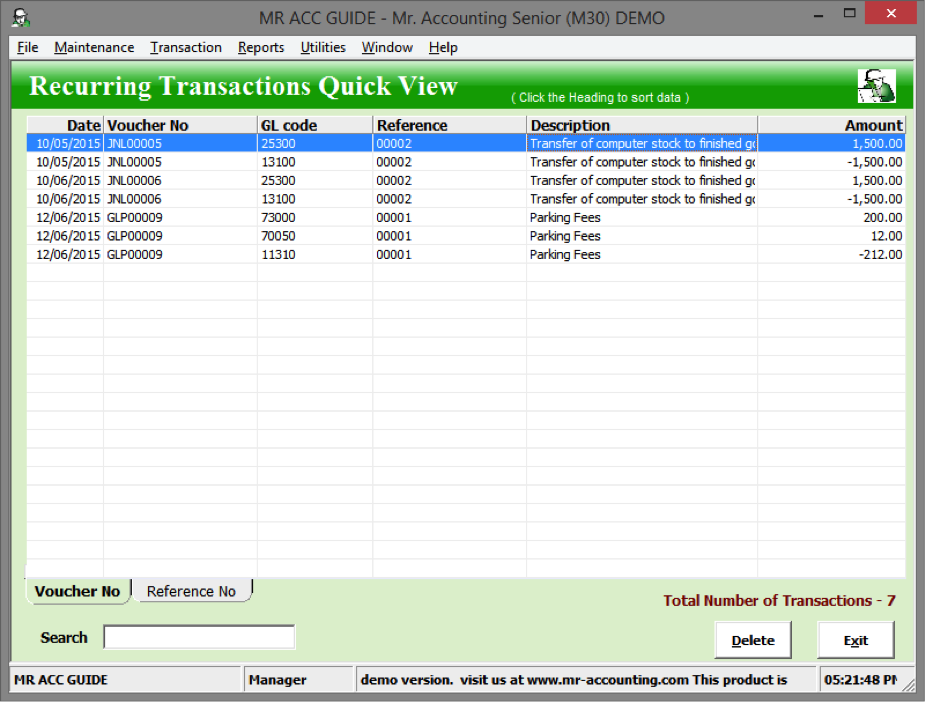

This opens up a recurring

transactions quick view screen for viewing posted recurring transactions. You

can view the summary of details and also delete the posted entries from this

screen.

You can select the Process button to post the saved recurring transactions to the GL.

1.

Show Due Entries Up

To: This filters transactions to this date or

before

2.

Post to

GL: Select this to post the selected transaction to

GL