The Closing

Stock feature is used for doing

closing stock using the method of periodical inventory. You don’t have to post

closing stock for perpetual inventory because each stock in and stock out

transaction automatically updates the stock code in the general

ledger.

Note: Perpetual Inventory is only available in Mysoft

ERP system, a more advanced version

You would enter the closing stock figure for example after you

perform a stock take at the month end or year

end.

The two methods to perform closing stock are summarised in the

table below:

|

Method |

Table format |

Journal format |

|

What is it? |

This uses a table to key in closing stock for each month.

|

This uses journal entries to enter closing stock. You need to

key in a debit and credit entry. |

|

Advantages |

Amount of closing stock each month can be easily changed

after saving. |

Easier to perform audit on journal entries. Journal entries

appear in Audit Trail

report. |

Both methods post the figure to Closing Stock under cost of sales in

the statement of profit or loss and Finished Goods under current assets in

the balance sheet.

Select Admin Tools

→ Company Settings.

1.

Tick to use Journal format,

untick to use Table

format

It is recommended to use table format

to enter closing stock, as it is easier to use and understand.

Example:

Stock take performed at the end of

January showed finished goods of 100000, raw materials of 10000 and work in

progress of 10000.

1.

Enter these amounts

under the month of January

2.

Carry forward

function: [see

below]

Carry forward function

Example:

3.

Enter 100000 as Stock – Finished Goods in

January

If you tick the checkbox, then

the amount automatically carries forward to future months [see red box

below].

If you untick the box, then it will not carry over, the remaining months have no balance and are empty. The closing stock only carries forward to become opening stock for the next month [see red box below].

The Closing

Stock screen changes to a

journal format if this is ticked.

Select General Ledger

→ Closing

Stock.

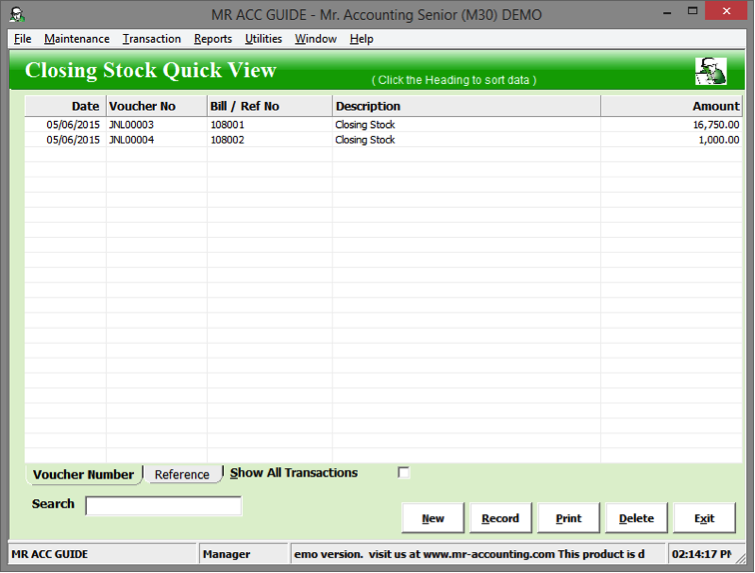

Closing Stock Quick View

screen.

Create New/Edit closing stock

transaction

Select New to create new entry

and double click on a

transaction to edit.

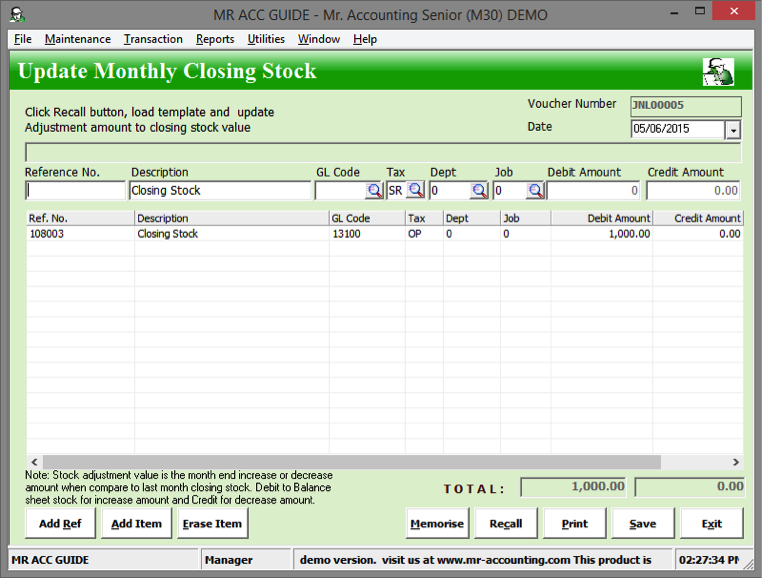

Note: If you have done many closing

stock adjustments previously, then you can use the Memorise function to save a template,

then use the Recall function to load

this template and change the amounts to save

time.

How to enter closing stock after stock take

Example:

The stock take showed a total amount of 16750 as closing stock for

this month.

1.

Debit Finished Goods (13100)

for 16750.

2.

Credit Closing Stock Adjustment for Finished Goods (69997) for 16750.

How to make subsequent

adjustments

Example: Next month, the stock take

showed a total amount of 17750 for closing stock. You

need to do an adjustment to increase closing stock by 1000.

1.

Date: date of stock take next month

2.

Debit Finished Goods (13100)

with 1000.

3. Credit Closing Stock Adjustment for Finished Goods (69997) with 1000

These transactions are reflected in

the profit or loss statement and the balance

sheet.

The profit or loss statement shows

the closing stock of 16750 for June and the adjustment of 1000 in July [see red

box below].

The balance sheet shows the finished goods of 17750 after the 1000 adjustment [see red box below].

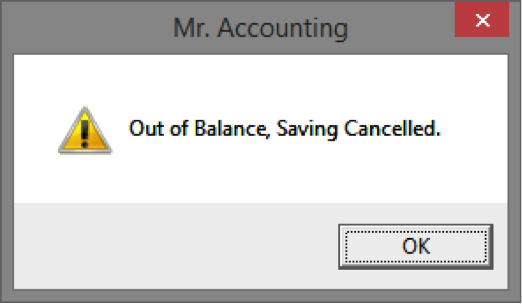

Out of balance

You need to balance the debit and credit totals for the Closing Stock journal format. You cannot save if they are out of balance. A message will pop up as below if you select Save.

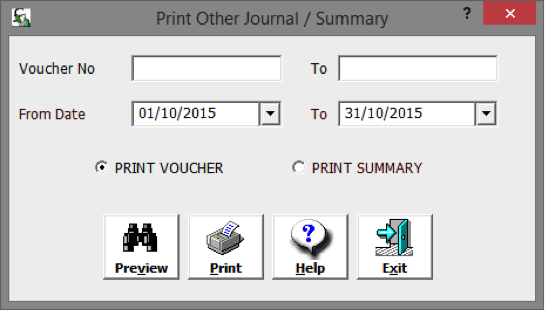

Select Print from the Closing Stock Quick View screen to open a new window as below. This is similar to the window for Other GL Journal.