The Bank

Reconciliation function can be used to

reconcile the differences between the records in the accounting system and the

bank statement. This keeps a record of these differences and you can also print

out a bank reconciliation statement showing the reconciled and unreconciled

transactions. Note that no double entries are automatically posted from this

function.

The timing differences between the transactions saved

into our system and the transactions in the bank statement can be due to unpresented cheques that have not yet

been cashed by our payee, uncleared

deposits due to cheques not yet cashed in by us or not processed by the

bank, and bank charges and bank interest that only appears on the

bank statement.

Back Reconciliation Quick View screen

1.

Double

click on a bank code to reconcile

Key in the bank statement date in the new window that pops out as below.

1.

Select the date on your

bank statement. Take note of the dd/mm/yyyy format. Select OK.

You will come to this screen which displays all

cash/bank transactions involving this bank code and their

details.

1.

Select records based

on:

Transaction Date: The filter for the

period applies to the transaction date (i.e. the date you selected when you

create the transaction). Only unreconciled transactions appear, unless

you tick the Include Reconciled Transactions, which displays reconciled

transactions in red.

Reconciled Date: The filter for the

period applies to the reconciled date (i.e. the date you reconcile the

transaction in Bank

Reconciliation). Only reconciled transactions appear which are

displayed in red.

2.

Report: This is to

display a report for reconciled, unreconciled transactions or both [see

below].

3.

BROI: see below

4.

Print BRS: This

displays a report to reconcile the differences between the cash book in the

system and the bank statement [see below].

5.

You can filter

transactions by this period.

6.

Refresh Quick View:

This clears all unsaved reconciliations

7.

After reconciling,

select Save.

You can

match using each column in the Bank

Reconciliation

screen. The best way is to match using cheque number, where available. You can

also match using amount, although

there may be some transactions with the same amount. You can look at the Description for further

clues.

Example: The bank statement contains receipts from cheques numbered RHB0010 (amount 1000) and RHB0011 (amount 1060).

1.

Match using Cheque

No

2.

Match using

Amount

3.

Left click to reconcile and put an

“X”

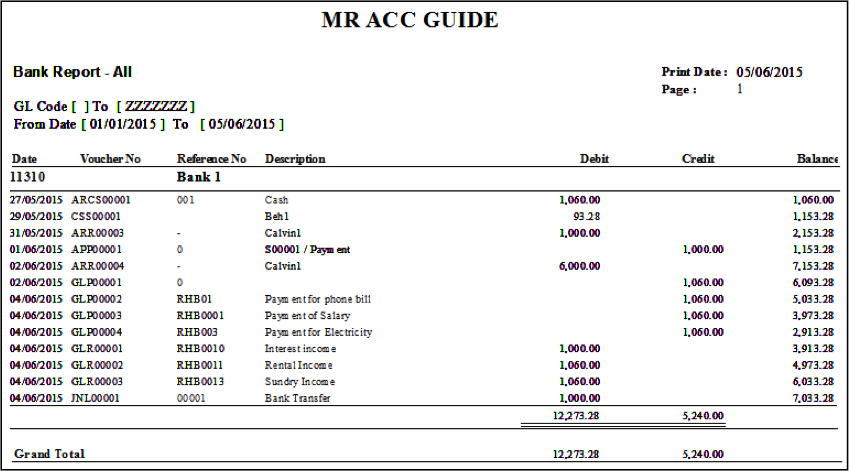

The Report

button allows you to display the transactions for the selected

bank codes.

You can select to filter

transactions based on whether they have been reconciled in Bank

Reconciliation. You can also filter by

unreconciled transactions, or both [in red box].

Example:

This displays all transactions for

the selected bank codes. Both

Reconciled and Unreconciled Transaction checkboxes were

ticked.

You can use the BROI function to key in unreconciled

transactions from previous software, or from the bank reconciliation records

done manually. These are unpresented items that

have not showed up in the bank statement

yet.

Example:

There are two unreconciled transactions for

electricity bill and rental income in the old accounting system, which have not

yet appeared in the bank statement.

1.

O/S Receipts or O/S

Payments: These are for receipts or payments that

have been entered into the system or posted in the manual accounting records,

but have not yet appeared in the bank

statement.

2.

Date: The closing date (i.e. the day before you first start using Mr

Accounting)

3.

Reference

number: use the cheque

number

4.

Enter 1000 for O/S Payment for electricity bill and press Enter

5.

After selecting Save, these items appear as unreconciled transactions in the

Bank

Reconciliation

screen

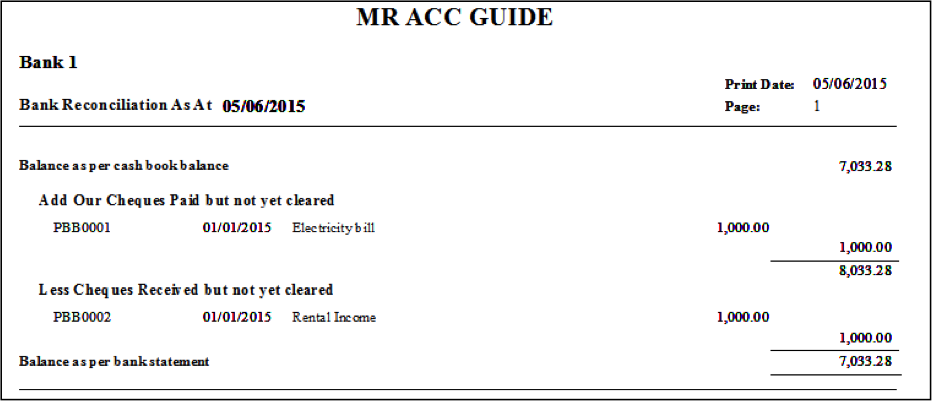

You can select the Print BRS button

to display a bank reconciliation statement.

This report shows the balance as per

the cash book entered in the system and all unreconciled transactions

(e.g. unpresented cheques, uncleared deposits) which when added up should tally

with the balance in the bank statement.

You can check the bank statement figure in the report

to see if it matches with the actual bank statement. If not, there might be

errors.

Example: