The Other

GL Journal transaction is used to

perform journal entries. Transactions that do not involve customers, suppliers,

cash book, invoicing etc should be entered here. They only involve the listing

of accounts in the general ledger.

You need to have some accounting knowledge to key in

transactions here. The debit and credit totals need to be balanced before you

are allowed to save.

Examples:

·

Keying in opening balances for the general ledger

using a trial balance from the previous

period

·

Another

method to do depreciation (instead of using the Fixed

Asset

module). You can depreciate for a yearly amount from this screen

Note: There is no update to

the GST Return form from this screen. Therefore, only out-of-scope transactions (those with

the tax codes OP & OS) should be created here.

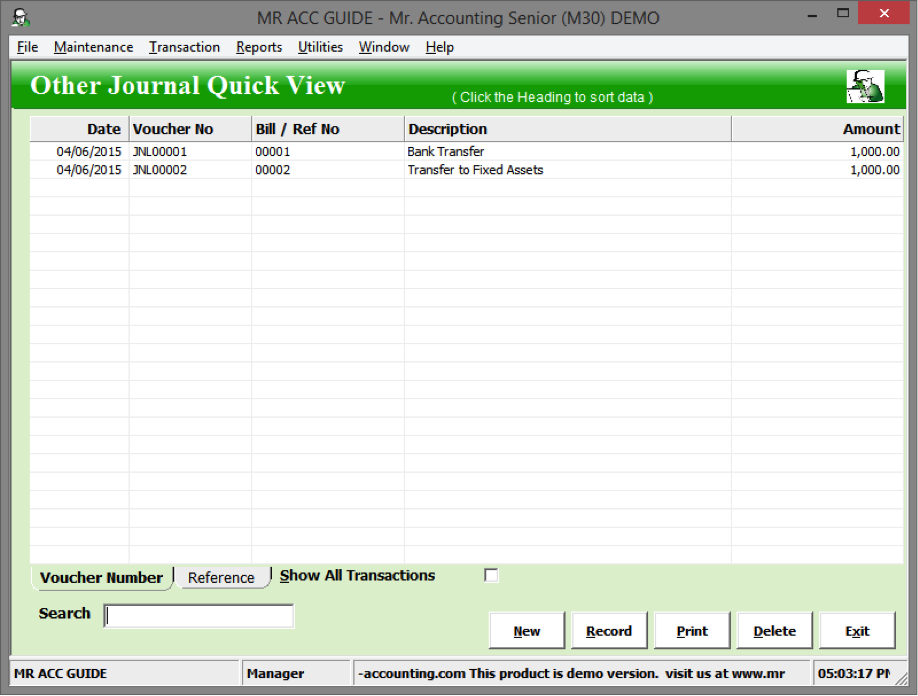

Other GL Journal Quick View screen

Select New to create new entry

or double click on a

transaction to edit details.

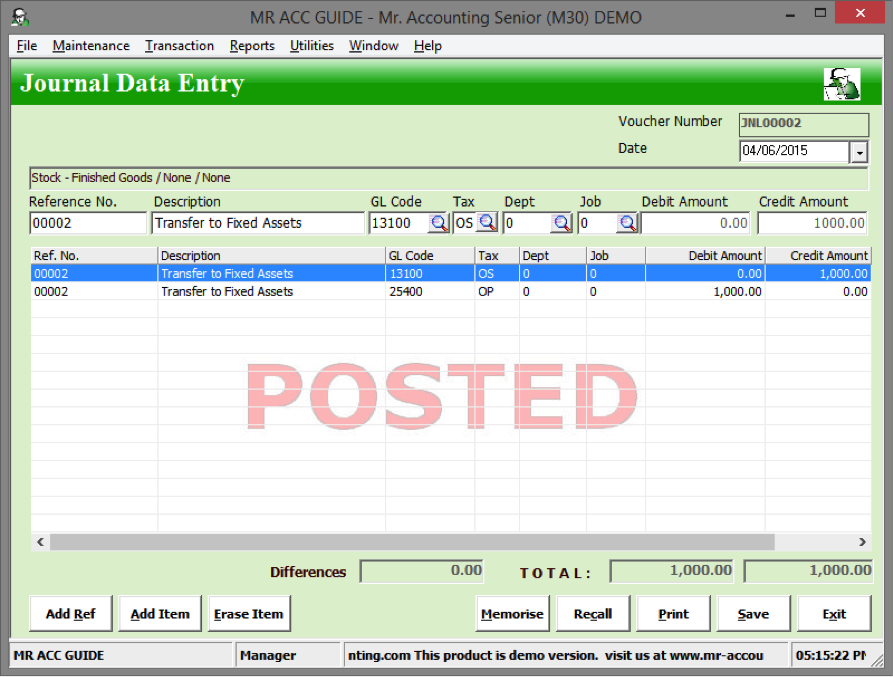

Example: Using stock

from inventory as fixed assets. We use Other

GL Journal as this only involves the

account list in the general ledger.

You should use the Closing

Stock

button to perform the stock take at the end

of the period. The Other

GL Journal transaction is only to perform recategorisation of stock

(e.g. to fixed assets).

Example: When selecting a stock GL code (e.g. 13100, 13200, 13300), then a message pops out reminding you to post closing stock entry using the Closing Stock button.

The totals for debit and credit sides must be balanced

in this transaction [see red box]. If there is a difference, then the

transaction cannot be saved.

1.

A new window pops up if

you try to Save which prevents you

from saving

2.

There is still a

difference of -1000 (credit

balance).

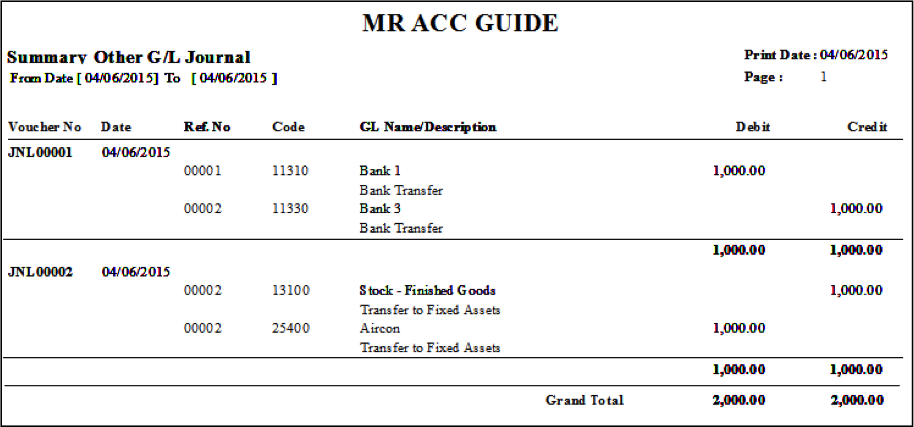

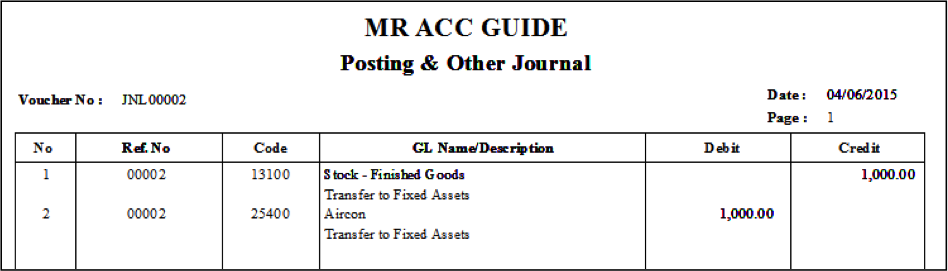

Select Print in the Quick View

screen and the new window below will pop

out.

1.

Select format to print (see

below)

This displays the accounting double entries for each

voucher (one voucher per

page).

This displays double entries including

voucher number and

date for each voucher.

Multiple vouchers are displayed per page of

report.