You can use the Disposal function to

sell off a fixed asset. The fixed asset is treated as disposed off for no money,

and the entire net book value is written off as an expense (under 7XXXX GL

code).

You need to create a

separate sale transaction to reflect money you received from the sale. You can

create a Cash

Book Receipt under the General

Ledger module for

this.

Disposal Quick View screen

1.

Update GL

button: see example

below

2.

Print: This displays the details of the disposal transaction [see example

below]

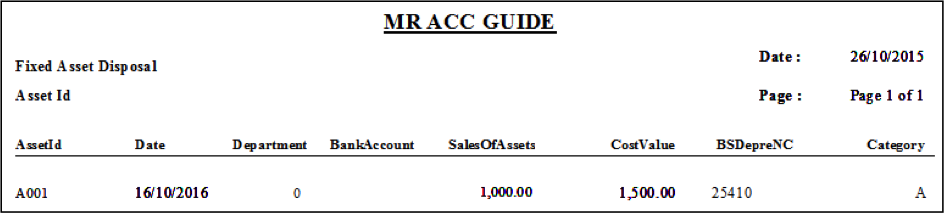

Example: Print Disposal

transaction

Note: You can

only select one Disposal transaction to print each time

Select New to create a new

disposal transaction and double click on a

transaction to edit.

1.

The Asset Cost, Total

Depreciation and Net Book Value are derived from the Fixed Asset

Register

2.

Disposal Amount: This

is the amount the fixed asset sold for

3.

Category Code is also

derived from Fixed Asset

Register

4.

It is

compulsory to set these disposal codes for

disposal

Asset

Code: Select the asset code to

be disposed off

Voucher

Number: This follows the format

set in Company

Settings under Admin

Tools

Asset

Name: This name is picked up

automatically after selecting the Asset Code

Disposal

Date: Select the date of the

disposal transaction

Disp Invoice

No: If available, you can

keep a record of the invoice number for the

disposal

Description/Sold

To: Enter a brief Description

of the sale or the person whom you sold to

Department and

Job code: You can select a

department and job for fixed assets for categorising and filtering

purposes

Disposal

Amount: You can make a note of

the sale amount of this fixed asset here. There are no GL postings for this. You

need to create a separate sales transaction for this (e.g. using Cash

Book Receipt in the General

Ledger if it is a cash

transaction, or Sales

Entry if it is a credit

sales)

Gain/Loss: You can see

the gain or loss from this disposal here. This is calculated automatically after

you enter the Disposal Amount. It is

the difference of the Net Book Value

and the Disposal

Amount.

Disposal GL Codes

|

Account Name |

Debit (DR) or Credit (CR) |

GL Code |

|

Asset Cost |

CR |

2XXXX |

|

Asset Accum Depreciation |

DR |

2XXXX |

|

Disposals account |

DR & CR |

7XXXX |

You can select the Update GL button from the Quick View

screen to automatically post GL double entries based on the selected GL codes.

You can see the double entries that

will be posted to GL below. The balances from the fixed asset cost and fixed

asset accumulated depreciation GL codes are cleared into an Assets Disposals

account which is an expense GL code (7XXXX) [see below]. The fixed asset is

treated as fully written off.

Follow the steps to post to GL.

Step 1: Select Update

GL.

Step 2: Select Yes to

confirm

Step 3:

You will notice that the Update to GL checkbox is

ticked [see red box]