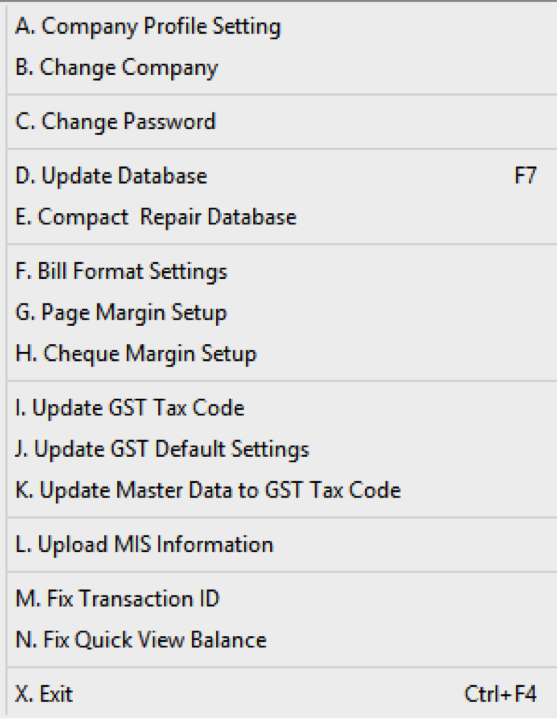

You can edit the company details that you have entered when you first created this company.

1.

GST Start

Date: This is a compulsory field that cannot be left

blank. Enter either the registration date for GST or the date when GST was

passed into law (1/4/2015).

2.

The financial period should be 1 year, e.g.

start 1 Jan and end 31 Dec.

This is to switch to another company data.

1.

Select the company to

switch to and then select OK.

Note: there is no option to create a new company from this screen. You need to restart Mr Accounting in order to create a New Company.

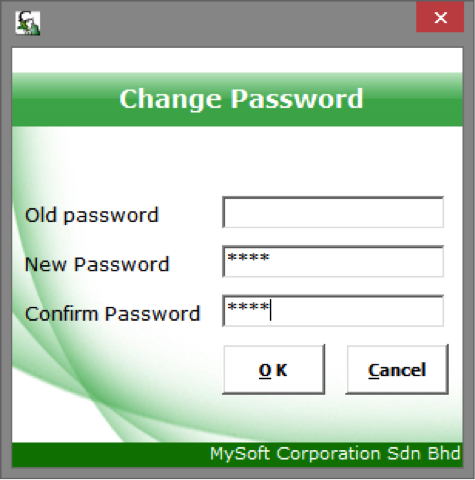

You can change the password for the

current user here. Type in your old password, and the new password. The Confirm

Password field should match the New Password

field.

You should update database after

updating to a new .exe and after data import. This will

update changes in the program to the database (the .mdb Microsoft Access file).

You need to go out to the Main Menu first before

you can update database.

This is to compress the size of the

database and repair errors in the database. You should use this function

frequently if your database size is getting big. The maximum database size for

Microsoft Access (which is used in Mr Accounting) is

2GB.

For example, if your database is 1GB+ you should

compact and repair daily.

Remember to perform the

Backup

Data function regularly to

prevent loss of data, as sometimes this feature can corrupt your

data.

This is a shortcut to invoice

Bill

Format Settings under Admin

Tools.

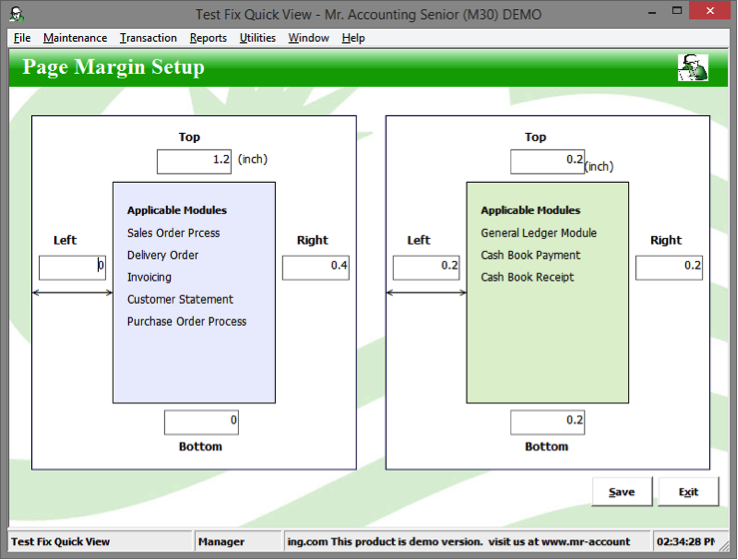

This is to set the page margins for the selected

reports.

Example: Set the Top

margin to 1.2 inch and Right to 0.4 inch for Invoicing

module.

You can preview an invoice to see the changes made to

the page margins.

2.

Left

margin set to 0

inch

3.

Right

margin set to 0.4

inch

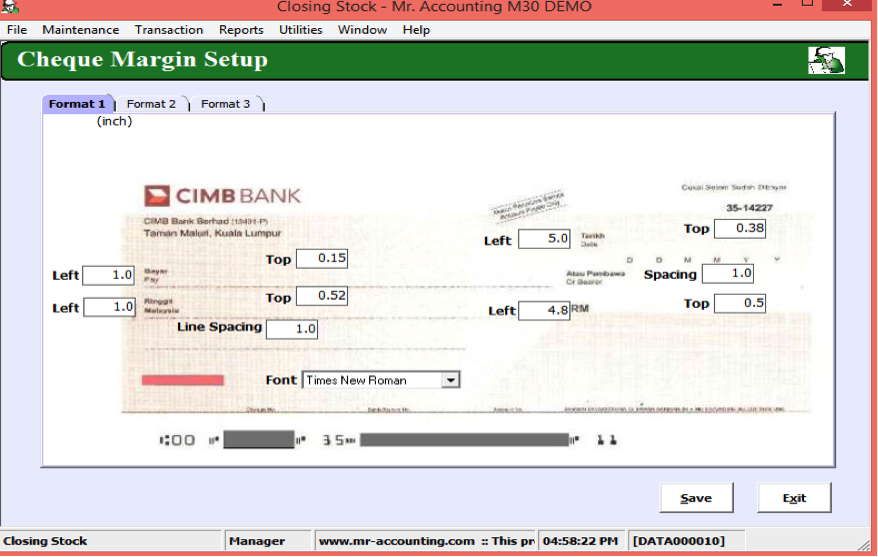

This is to set

the margins when

printing a cheque from

Supplier

Payment and

Cash

Book Payment. As you can

see from the tabs, there are 3 formats [see red box below]. Therefore, you can

measure and preset margins for 3 different types of

cheques.

The format is linked to the Bank GL code you pay money out from. You can edit the format by selecting General Ledger → Account Maintenance → Bank GL code.

Example: Edit Cheque Format for “Bank 1”

GL code

1.

Cheque Printing Format:

Set this to one of the preset formats above (Format

1-3). This only appears for bank GL codes

with the Search Group “1. Cash

Book”.

The Cheque printing option

is selected from the Print button in

Supplier

Payment Quick

View…

…Or from the Print button in Cash

Book Payment Quick

View.

You should use this function after installing the program & updating

the .exe version.

This adds the latest GST tax codes

into the Tax

Settings (e.g. the new Purchase

Tax Codes and Supply Tax

Codes).

Note: This function does not change the tax rate back to the original

rate if you have changed it previously. For example, if you change SR to 0% then

it will not revert back to 6% after selecting this

function.

You should use this function after installing the program for the

first time.

This creates new tax GL codes (e.g. Input and

Output tax control accounts) to use for the Default

Settings for the

GST

module.

This function is to update old tax codes used in

the system to new ones

in the master files, under the Default

Settings tab in Customer

Master and

Supplier

Master.

For example, the code Ts was used for customers and suppliers

and was imported into the new GST version. This code will be updated to SR for all customers in the

Customer

Master and TX for all suppliers in the

Supplier

Master after selecting this

function.

This function allows user upload the latest MIS information to the

Cloud site.

This function is allow user to fix the transaction when user unable

save the transaction cause by duplicated transaction

ID.

This function allows you to fix errors with the Quick View screen.

For example, the Quick View screen amount may not tally with the

amount in the database. Selecting this function refreshes the Quick View screen

to match with the amount stored in the

database.

This will exit the program.

Other ways to exit Mr Accounting are

clicking on the Backup and Exit

button from the Main Menu and

selecting the red “X” button at the

top right hand corner of the window.

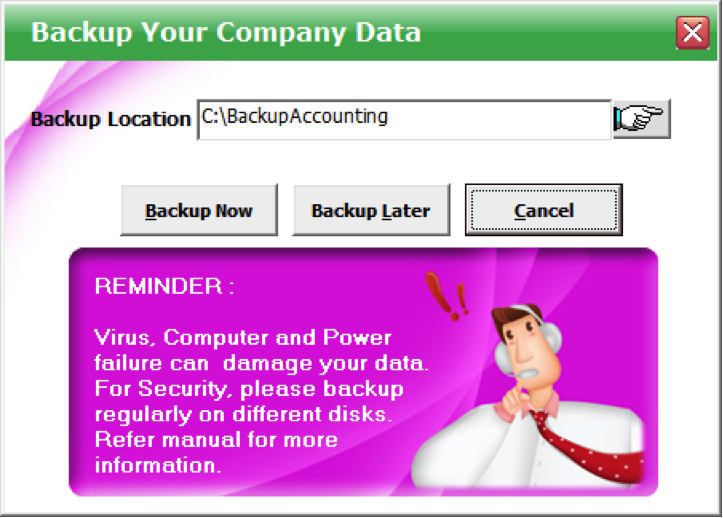

A new window opens prompting you to

backup your data first. You can select the backup directory and select Backup Now to start the backup in the

selected backup directory and exit, or the Backup Later button to exit without

backing up your data. The Cancel

button returns you back to your previous

screen.