A delivery order refers to an order given by an owner

of goods to a person in possession of them (the carrier or warehouseman)

directing that person to deliver the goods to a person named in the

order.

Stock is considered as

despatched and deducted from free stock after the delivery order document has

been created in the system. However, there is no accounting effect at this

point. (Accounting double entries are posted in Issue

Invoice).

From the transaction

screen, you can pick up Sales

Order documents. You pick up

created delivery order documents under Issue

Invoice.

Issue Delivery Order Quick View screen

1.

Invoice

No: If the DO has been picked up/converted into an

invoice, then the invoice no is for that DO is displayed

here

2.

Days: show how many days after the DO has been

issued

3.

DO

Printed: If ticked, this means that DO has been

printed before

Note: The delivery order entry

is shown in red if it has been 21 days or more since it has been

issued and it has not yet been picked

up in Issue

Invoice. This lets you know which delivery orders

need to be adjusted for under DO Tax

Clearing in the Sales Entry

Adjustment screen under the GST

module.

(The GST 21-day rule states that delivery orders that

have not yet been converted into an invoice after 21 days or more must have

their tax figure declared and provided for in the GST-03 Return Form. The tax

point is the date of issue of the delivery order)

Select New or double click on a delivery order in the Quick View screen to enter this new screen.

1.

Use another Delivery Address created in

Customer Master

2.

The SOP No and Sales Order No are filled up if you

pick up from Sales

Order

3.

Analysis

Code: This is picked up directly from the

Customer

Master

4. The terms is taken from the credit terms field under Default/ Credit Settings in the Customer Master

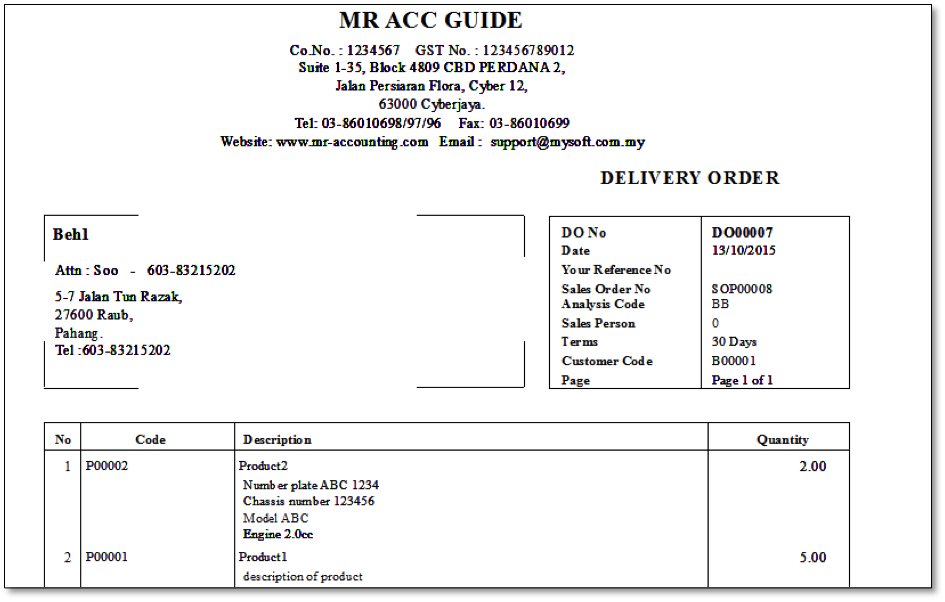

After creating a delivery order, you

can select Print to print the

document.

Example:

Note: Only the

quantity is displayed on the

delivery order and not amount, because delivery order only affects stock control and there is no accounting

effect.

Although there is a separate report file (IN-DO363-N1.RPT) for “customise report” which you can edit yourself with Crystal Reports, by default, this report file is no different from the normal format.