An invoice, bill or tab is a

commercial document issued by a seller to a buyer, which relates to a sale

transaction. The invoice indicates the products, quantities, and agreed prices

or services the seller had provided the buyer. The term invoice indicates that

money is owed or

owing.

The payment terms are also stated on

the invoice, which specifies the maximum number of days to settle the invoice,

and a ‘settlement discount’ is sometimes offered if payment is made before the

due date. In some cases, the buyer has already paid for the products or services

listed on the invoice.

The invoice in this screen refers to

a sales invoice, whereby we are

issuing the invoice from the point of a seller. The invoice is called a purchase

invoice if we are receiving the invoice (e.g. from a supplier) from the point of

a buyer.

The invoice is the starting point

for GL double entry postings for

sales transactions. The accounting double entries are automatically posted to

the trade debtor control account and the selected GL code in the invoice

transaction screen.

Issue Invoice Quick View screen

1.

Reference: This is picked up from the Your Reference No field in

Issue

Invoice details

screen

2. The print checkbox is ticked after the invoiced has been printed (for checking which invoice vouchers have been printed and issued)

Select New to create new invoice

or double click an invoice

to edit.

1.

Use another Delivery

Address created in Customer

Master

2.

Your Reference

No: This is shown

in the Invoice Quick View screen

3.

Pickup:

The details

picked up are from Delivery

Order

Note: The Contact field in Issue Invoice [in red box] picks up the Contact Person name and the Contact Person Phone No, whereas this field in Issue Delivery Order picks up the Contact Person name and Customer Phone No [see below]

Example: Customer Details for customer

Beh1

1. Customer

Phone No: Used in Delivery Order

2. Contact

Person Phone No: Used in Issue Invoice

If you want add some extra information for a product in invoice. Users’ can press magnify glass under Extra Note and Tax Code to call out this field to add extra information.

1.

Under Description

column users’ can key the long description for your

product.

2.

If you give additional discount for one product users’ can give

discount percentage or amount.

3.

Users’ also can make decision whether want inclusive or exclusive

tax in you unit prices by tick it the Inclusive Tax. If want exclusive users

just to untick the Inclusive Tax box.

After creating an invoice, you can

print the invoice document to be issued to your customer. This follows the

format of a Tax Invoice if you have enabled GST when creating a

company.

Select Print in the Invoice Quick View

screen.

1.

Range of invoices

to print

2.

Customise

format

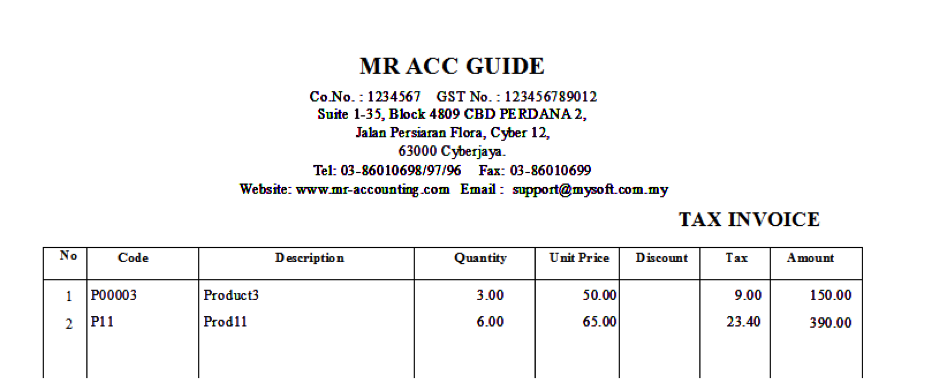

Example:

Default “customise format” for

invoices

Note: There is no heading for the customer details and no invoice details at the top for the customise format.

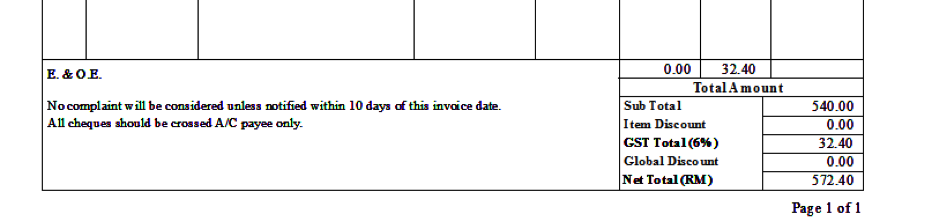

Example:

Default normal format for invoices (“Customise

format” unticked)

Note: There are headings for the customer details and

invoice details at the top for the normal format.